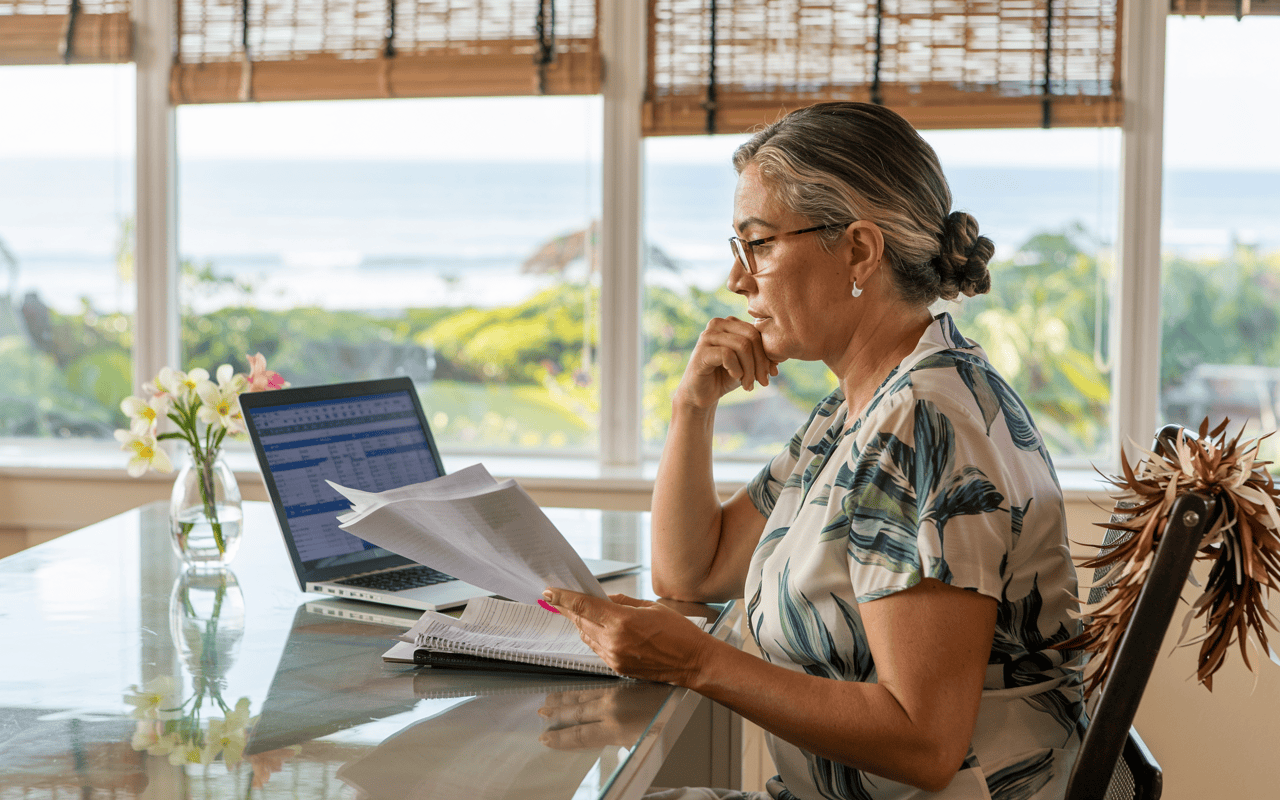

Cash Flow Management Tips for Hawaii Businesses During Economic Uncertainty

If you're running a business in Hawaii, managing your cash flow has never been more crucial. Between rising wages, fluctuating tourism, and growing import costs, Hawaii employers must proactively strengthen their financial foundations.

In this guide, we explore how Hawaii businesses can protect revenue, reduce costs, and plan ahead—plus offer a free resource to help:

Understanding Hawaii’s Economic Landscape in 2025

From Maui to Hilo, local companies are facing unique financial challenges:

- Import tariffs now exceed 10–145%, making it more expensive to source goods.

- Wages have jumped, with Hawaii’s average rising from $53K (2020) to over $70K in 2025.

- Tourism remains inconsistent, with spending shifting toward budget-conscious experiences.

Supply chain issues continue to affect inventory and operating costs in industries like construction, food, and logistics.

7 Cash Flow Management Strategies for Hawaii Employers

1. Flexible Forecasting to Improve Cash Flow

Why it matters:

Financial agility starts with having visibility. Cash flow forecasts help you anticipate shortfalls, plan for seasonal dips, and quickly respond to market changes.

Key actions:

- Build monthly forecasts for best, moderate, and worst-case scenarios

- Account for tourism seasonality and tariff-driven cost increases

- Adjust your numbers frequently to stay ahead

2. Build Liquidity Reserves for Financial Resilience

Why it matters:

Cash on hand is a lifeline. Liquidity ensures you can cover payroll, vendors, and operating costs during economic dips—without panic or taking on costly loans.

Key actions:

- Reserve 2–3 months of core operating expenses

- Proactively expand credit lines before you urgently need them

- Tighten up receivables with incentives for early payment or structured follow-up

Is Your Cash Flow Strategy Ready for 2025?

3. Cut Expenses with Precision, Not Panic

Why it matters:

Slashing costs across the board can damage morale and operations. Strategic expense management ensures you're reducing waste without weakening your core business.

Key actions:

- Audit all expenses to identify what’s mission-critical vs. discretionary

- Renegotiate terms with suppliers, landlords, and vendors for more favorable rates

- Consider outsourcing high-overhead admin functions like:

- Payroll services

- HR compliance

- Benefits administration

- Payroll services

📉 Trimming smartly preserves agility while maintaining service quality and employee satisfaction.

4. Protect Revenue and Adapt Your Offerings

Why it matters:

Revenue diversification protects your business from external shocks—whether that’s a dip in tourism or a global supply chain issue.

Key actions:

- Offer new services or packages less dependent on imports or visitor volume

- Invest in customer loyalty through proactive communication and personalized care

- If price increases are necessary, be transparent—customers respect clarity tied to economic realities

🔄 Hawaii businesses that pivoted quickly during past downturns recovered faster and emerged stronger.

5. Strengthen Employee Retention to Avoid Turnover Costs

Why it matters:

Turnover is expensive. The cost to replace an employee can range from 50% to 200% of their annual salary—and hiring delays can slow productivity.

Key actions:

- Offer meaningful benefits and strengthen your company culture

- Cross-train staff to enhance team flexibility

- Provide hybrid or remote options where possible

💬 Happy, stable teams contribute directly to more predictable financial performance.

👉 Discover top retention strategies for Hawaii employers

6. Stay Compliant to Avoid Legal and Regulatory Risk

Why it matters:

Even a single lawsuit or violation can create a massive cash drain—and erode trust with your team or customers.

Key actions:

- Regularly audit HR practices and stay compliant with local, state, and federal labor laws

- Ensure workers’ comp and insurance policies are up to date and industry-specific

- Train managers on documentation, performance, and employee relations best practices

💸 Fines and legal settlements often exceed six figures—compliance is one of the most cost-effective risk mitigation tools you have.

7. Rethink Payment Structures for Predictable Cash Flow

Why it matters:

Lumpy cash flow—due to large annual bills or irregular payments—can destabilize otherwise profitable businesses.

Key actions:

- Convert large one-time payments (like insurance true-ups) into monthly or quarterly installments

- Pre-allocate reserves for known annual liabilities

- Revisit vendor contracts to stagger payment terms

📈 More predictable outflows make it easier to forecast, plan, and sleep at night.

💬 Key Questions to Evaluate Your Cash Flow Readiness

Use these to guide your planning:

- Is my forecast updated and scenario-based?

- Have I built cash reserves and secured flexible credit?

- Are my expenses aligned with business priorities?

- What’s my strategy for reducing turnover costs?

- Have I minimized legal and compliance risks?

- Are my vendor payments staggered to avoid spikes?

🧾 Want to evaluate your cash flow strategy step-by-step?

📥 Download our free Cash Flow Management Action Plan

💼 Partner with ProService Hawaii

Managing your business’s cash flow doesn’t need to be overwhelming. With the right partner, you can streamline operations, protect your people, and stay financially resilient.

ProService Hawaii helps local employers with:

- Payroll services

- Workers’ Compensation & risk management

- Employee benefits and retention strategies

- Comprehensive HR support and compliance

We’ve helped thousands of Hawaii businesses like yours navigate tough seasons—and we’re ready to help you, too.