What is the Shuttered Venue Operators Grant?

For a long time now, events and venues affected by the COVID-19 pandemic have been waiting for relief that would address the live event industry's unprecedented losses. After much waiting, the Shuttered Venue Operators Grant, or SVOG, is launching in April. Here's what you need to know…and how to be prepared to apply.

What is the Shuttered Venue Operators Grant?

The Shuttered Venue Operators Grant is the SBA’s plan to support the live events industry. It is part of the Economic Aid to Hard-Hit Small Businesses, Nonprofits, and Venues Act, which was signed into law on December 27, 2020 as a special provision within the Consolidated Appropriations Act of 2021. It includes over $16 billion in grants to shuttered venues and reserves $2 billion for eligible applications with up to 50 full-time employees. Since the program is set-up as a grant (instead of a loan), funds do NOT need to be repaid.

Who can apply?

Eligible entities include:

- Live venue operators

- Live venue promoters

- Theatrical producers

- Live performing arts organization operators

- Motion picture theater operators

- Theatre operators

- Talent representatives

- Museum operators, zoos and aquariums

Other requirements:

- Must have been in operation on Feb 29, 2020

- Must not have an application pending for a PPP loan

- A reduction in gross revenue of at least 25% when comparing the same quarter from 2020 and 2019

Who is ineligible to apply?

A venue operator is NOT eligible if any of the following apply:

- Received a PPP loan on or after Dec. 27, 2020

- More than 10% of 2019 gross revenue came from the federal government

- Is a publicly traded corporation

- Presents live performances or sells products or services of a prurient sexual nature

- Operates in more than one country or in 10+ states; AND it had more than 500 employees as of 2/29/20

* See more specific requirements by business type, outlined by the SBA.

How much money can I expect to receive?

It depends on when your organization was in operation:

If you were in operation BEFORE January 1, 2019, the grant will equal 45% of your 2019 gross earned revenue, up to a maximum of $10 million.

If you began operations AFTER January 1, 2019, the grant amount will be the average monthly gross revenue for each full month you were in operation during 2019, multiplied by 6, up to a maximum of $10 million.

When do applications open for the Shuttered Venue Operators Grant?

The SBA will begin accepting applications through its portal on April 8, 2021. It will process applications based on the degree of economic loss suffered by your organization/how much revenue was lost.

- First priority (Days 1-14): For organizations that lost 90% or more of revenue between April 2020 and December 2020

- Second priority (Days 15-28): For organizations that lost 70% or more of your revenue between April 2020 and December 2020

- Third priority (Days 28+): For organizations that lost 25% or more of your revenue between April 2020 and December 2020

- Supplemental Funding (after First/Second Priority): For organizations that are awarded a First or Second Priority grant, and lost 70% or more of your revenue in most recent calendar quarter (as of April 1, 2021)

What should venue operators be doing now?

The SBA is encouraging applicants to take steps NOW to prepare while it builds the program portal. Here are its recommendations:

- Obtain a Dun & Bradstreet (DUNS) number so you can then register in the System for Award Management (SAM.gov). Other identifiers, such as an Individual Taxpayer Identification Number or Employer Identification Number, cannot be used.

- Register in SAM.gov immediately after you receive a DUNs number as the SAM registration may take up to two week after submission.

- Gather documentation showing your employee count and monthly revenue so that you can calculate the average number of qualifying employees your entity has had over the prior 12 months (see page 20 of FAQs)

- Determine extent of gross revenue loss experienced in 2020 compared to 2019 (see page 21 of FAQs)

How can I use funds from the Shuttered Venue Operators Grant?

You are allowed to use the funds to cover essential operation expenses, labor costs, taxes and debts.

Eligible labor-related expenses:

- Payroll costs

- Expenses related to worker protection

- Payment of independent contractors, as long as the annual compensation does not exceed $100k per contractor

Eligible operating expenses:

- Payments for your rent and utilities

- Ordinary business expenses as well as maintenance costs

- Administrative costs as well as fees and licensing

- State and local taxes

- Insurance payments

Eligible debt and mortgage payments:

- Scheduled mortgage payments (not including prepayment of principal)

- Scheduled debt payments (not including prepayment of principal) on any indebtedness incurred in the ordinary course of business prior to February 15, 2020)

- Operating leases in effect as of February 15, 2020

Eligible production-specific costs:

- You are allowed to use the grant for advertising, production transportation, and capital expenditures related to producing a theatrical or live performing arts production, however this may not be the primary use of the funds.

You may NOT use funds from the grant:

- To buy real estate

- Make payments on loans originated after February 15, 2020

- Make contributions or other payments to, or on behalf of, political parties, political committees, or candidates for election

- Any other use prohibited by the Administrator

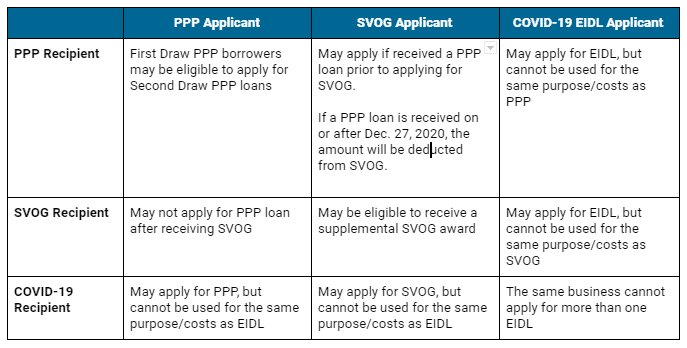

How does PPP and EIDL impact the Shuttered Venue Operators?

Where can I learn more about the Shuttered Venue Operators Grant?

- SBA’s Shuddered Venue Operators Grant

- Eligibility Requirements

- Cross Program Eligibility

- SVOG Frequently Asked Questions

- Application Checklist

Want to know how ProService can help with the Shuttered Venue Operators Grant and make running a business easier? Schedule a quick 15-minute business consultation to learn more.