- What We OfferOur bundled HR solution gives you a complete solution for

payroll, benefits, HR compliance and more.Withholdings, deductions,

direct deposit, and tax filings.Professional development, leadership and safety courses

Health insurance, 401(k)

plans, FSAs, and more!Professional development, leadership and safety courses

Hiring, onboarding,

handbooks, best practicesHiring, onboarding,

handbooks, best practicesCoverage, claims support,

safety programsDiscover how we’re

helping local companies - ResourcesBest practice advice for Hawaii

employersWatch our latest webinars,

get helpful guidesExpert articles and answers

to all your questionsTraining resources for our

client partners - About UsProService Hawaii helps

employers succed in HawaiiLearn about our upcoming events and community initiatives.

Our team is always

growing, come join us!Explore our latest

company newsKnow someone that needs

HR support? Let us know.We want to hear from you,

let us know how we can help.

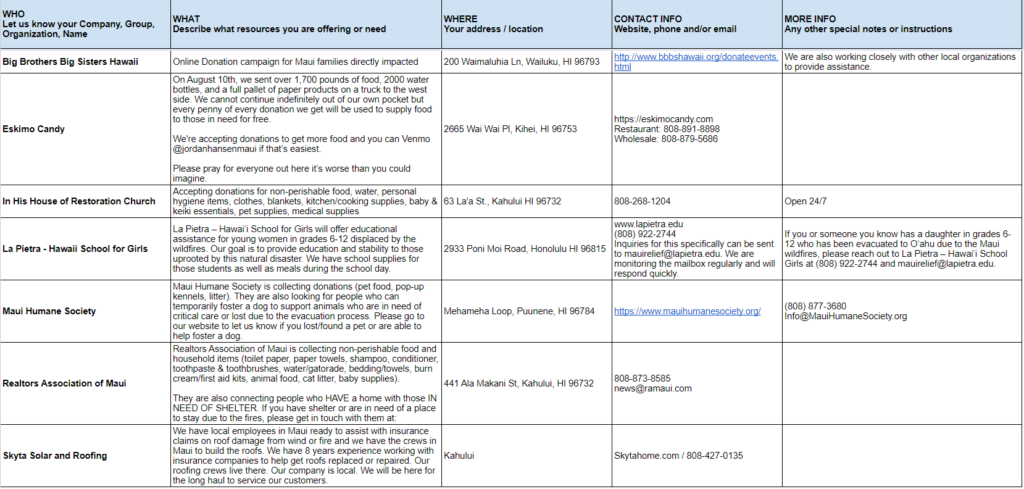

Resource Toolkit for Maui Employers

If the Maui wildfires impacted your business, we want to help you navigate what's ahead.

Standing with Maui

Our hearts ache as we witness the aftermath of the Maui fires. The extent of the loss is truly immeasurable, and we recognize the challenging journey ahead towards recovery and restoration. Please know that our thoughts are sincerely with all those who have been impacted during this trying period.

Below are resources available to you and note that we will continue to update this site with the latest information we come across.

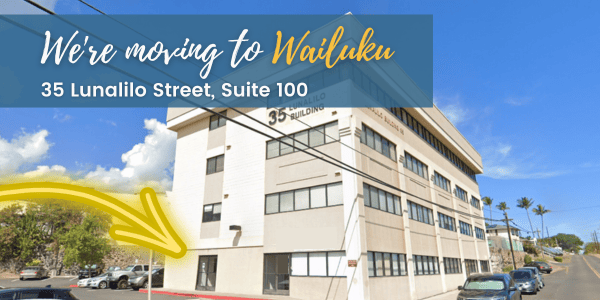

Our office is moving to Wailuku on Monday, August 28!

Recent Updates

See sections below with full details and resources:

- Maui Fire Disaster Relief Nonprofit Funding from Maui United Way [9/19] – Maui United Way has opened the nonprofit grant application process for Phase 2 of its Maui Fire Disaster Relief program.

- ProService 401(k) Qualified Disaster Recovery Distribution [9/1] – New benefit available, more details in the Employee Benefits section

- ProService Maui Wildfires Resource Sheet [PDF] – Printable resource with information on unemployment, benefits, and organizations offering disaster assistance.

- ProService Moving to Wailuku [Mon, 8/28] – We will be in our new office in Wailuku starting Mon, 8/28! Note: Our Kahului office will close after Fri, 8/25.

- In-Person Disaster Assistance in Upcountry [8/25] – A new disaster assistance center has been opened at the Mayor Hannibal Tavares Community Center in Makawao.

- Hawaii Disaster Recovery Jobs Portal [8/25] – New portal helping jobseekers with employment tools and job listings.

- Unemployment Benefits – The State has extended hours and is allowing employees to file a claim over the phone 7 days a week from 7 am to 6 pm.

- Mental Health Services – Six new mental/emotional support services added

- Giving employees Disaster Relief Payments – For employers interested in financially assisting affected employees under Section 139 of the IRS code.

Paying Employees

FAQs on how to handle payroll issues, and rules for paying exempt or non-exempt workers.

** OUR OFFICE IS MOVING TO WAILUKU **

Starting Monday, August 28, we will be in our NEW office in Wailuku located at 35 Lunalilo Street, Suite 100, Wailuku, HI 96793. Our Kahului office will remain open until Friday, August 25. We look forward to providing you and your employees with the same excellent service and support at our new location!

—————————————————-

For Employers: Please reach out to your Service Team directly or our main office for support.

- [Open until Friday, 8/25] Kahului Office: 74 Lono Avenue, Ste. 101, Kahului, HI 96732

- [Opens Monday 8/28] NEW Wailuku Office: 35 Lunalilo Street, Ste. 100, Wailuku Hi 96793

- Open Hours: Monday-Friday, 8:00 am – 5:00 pm

- Main Office Phone: 808-394-8878

- Email: [email protected]

- Online Resources: proservice.com/maui-resources

- ProService Maui Wildfires Resource [Printable PDF]

For Employees: Our Employee Service Center is available to assist employees with payroll and/or HR-related questions. Employee Service Center: 808-394-4162

- If you submitted hours this week, we have processed your payroll on time for direct deposits and physical checks.

- If you were not able to submit hours, please get in touch with your Service Team for assistance. Whether you have the ability to submit hours or no longer have access to employee data, your Payroll Processor will work with you on getting your employees paid.

- Physical checks: USPS has confirmed that delivery will go as planned for Maui, except for Lahaina & Kaanapali.

Special arrangements for employees with mailing addresses in Lahaina and Kaanapali:

- Paycheck pickup at our Kahului Office. Physical paychecks normally mailed to employees in Lahaina and Kaanapali will be held for pick-up at our Kahului office, and employees will need to verify their identity to pick up their checks.

- Unable to pick up your paycheck in Kahului? If your employee is unable to pick up their check, or if their check was lost in the mail or damaged, we can assist them with direct deposit setup or a one-time ACH deposit. Please direct your employee to call our Employee Call Center at 808-394-4162 to verify personal information and provide a photo of a voided check.

When natural disasters such as wildfires or hurricanes hit, employers should be mindful of their responsibilities under state and federal law. Here’s what you need to know about paying non-exempt employees:

- Non-exempt employees are usually hourly workers (although there can be exceptions*)

- According to the Fair Labor Standards Act (FLSA), employers must pay non-exempt workers only for the hours the employee actually worked. Therefore, if your business is unable to provide work to employees due to the wildfires, you are not required to pay non-exempt employees.

* If a non-exempt employee has agreed to work an unspecified number of hours for a fixed salary, you must pay these employees their full weekly salary for any week in which any work was performed.

When natural disasters such as wildfires or hurricanes hit, employers should be mindful of their responsibilities under state and federal law. Here’s what you need to know about paying exempt employees:

- Exempt employees are usually salaried workers, although there can be exceptions.

- According to the Fair Labor Standards Act (FLSA),if your employee worked part of the week (e.g. on Monday before the fires hit) employers are required to pay the employee’s full week of salary, even if your worksite is closed or unable to reopen.

- Employers can require exempt workers to use allowed leave (e.g. PTO days) for days they are unable to work and to drive down PTO balances

If your business is considering laying off workers due to the Maui wildfires, here’s what you need to know:

- Employers must pay all earned wages at the time of discharge (or no later than the next working day).

- If you are considering layoffs, please let your service team at ProService know so we can prepare final paychecks

As an employer, you may provide financial assistance to help your employees cope with this disaster by reimbursing some disaster related expenses. Section 139 of the IRS Code allows employers to provide Disaster Relief Payments to employees that are tax deductible for you and not subject to taxes for employees. Note: These payments are not considered employees' wages, and differ from cash advances or loans to employees.

Eligibility:

- Any employee working in the County of Maui directly affected by the Maui wildfires who incurred qualified expenses.

- Note: Employers can limit how much employees can receive, the deadline for submitting requests, and which employees may receive this benefit. If disaster relief payments are not available to all affected employees, then qualification criteria must be non-discriminatory and based on bona-fide employment classifications, such as length of employment, or full-time versus part-time status.

Relief payments:

An employer can provide a disaster relief payment to employees to cover “reasonable and necessary” expenses from a “qualified disaster” that are not compensated through insurance or other means, such as:

- Personal, family, living, or funeral expenses.

- Costs to rehabilitate a personal residence.

- Expenses to replace contents within a personal residence.

Tax benefits:

To the employer:

- Payments are tax-deductible.

- Payments are not subject to FICA and FUTA employment taxes.

To the employee:

- Relief payments are not taxable as income.

- Payments will not affect other federal benefits an employee already receives (e.g., Social Security, Medicaid, Supplemental Nutrition Assistance, etc.).

Documentation:

- Although having a written policy is recommended, due to the disastrous nature of this situation, it is acceptable for employers to verbally inform employees of this benefit rather than issuing a written policy.

- Employees do not have to submit receipts or proof of incurred expenses. However, there should be some form of written documentation from employees stating that they are requesting reasonable and necessary costs incurred by the wildfires to the employer, the amount requested, and expense categories for the requested amount. This is extremely helpful if the IRS audits the employee or employer in the future.

Resources:

Employee Benefits

FAQs about healthcare and other employee benefits for affected employees.

Employees who already had healthcare coverage as of August 1 will continue to have coverage through August 31. We recommend informing your employees that if they can pick up prescriptions or get key medical appointments, do so before the end of the month.

If you are interested in more healthcare options for your employees, please call us at 808-394-8878 to consult with one of our benefits experts.

Prescription Refills for HMSA members affected by the Wildfires:

HMSA is allowing early refills of maintenance medications for their members affected by the wildfires. A member must have refills available on their prescription and should call one of the HMSA Customer Care lines below:

- HMSA members who get their health insurance from their employer or buy it on their own: 1-855-298-2491

- Medicare Part D: 1-855-479-3659

- HMSA QUEST Integration: 1-855-479-3656

Free Counseling Services:

HMSA has a support line provided through Carelon Behavioral Health to support their members who are experiencing mental distress. Please call 800-580-6934 or click here to learn more about the free counseling services and additiona resources available to you.

Click here to get the latest updates from Kaiser Permanente for Maui.

Medical services in West Maui will be provided by Kaiser Permanente to members and non-members at no cost at the following locations in Lahaina:

- Mobile health vehicle at Lahaina Gateway Center – Provides first aid, pediatric services, and OB/GYN services. OB/GYN services begin August 14 and will be offered every Friday beginning August 18.

- First aid station at Hyatt Regency Lahaina, Lahaina Ballroom – Provides first aid services.

- First aid station at Napili Park – Provides first aid and pediatric services.

The following Kaiser locations are open:

- Maui Lani Medical Office: Monday through Friday, 8 a.m. to 8 p.m.; Saturday and Sunday, 8 a.m. to 5 p.m.

- Kihei Clinic: Monday through Thursday, 8 a.m. to 4:30 p.m. Friday, 8 a.m. to 4 p.m. Closed on weekends.

- Wailuku Medical Office: Monday through Friday, 8 a.m. to 5 p.m. Closed on weekends.

For prescription refills:

Members can visit kp.org/pharmacy or call 808-643-7979. Or, visit pharmacy locations at our Maui Lani or Wailuku medical offices.

Emotional health services:

If you are a Kaiser member, Kaiser has a partnership with Ginger, a mental health app, that allows you to text one-on-one with an emotional support coach anytime, anywhere. Download Ginger now at kp.org/coachingapps/hi. After signing in to kp.org, Kaiser Permanente members can set up a Ginger account at no additional cost.

- 24/7 text-based emotional support coaching

- Discuss goals, share challenges, and create an action plan with your coach

- Self-care resources recommended for your needs

Prescription Refills for HMAA members affected by the Wildfires:

Until further notice, HMAA and OptumRx have suspended restrictions around early refills for members heavily impacted by the wildfires. If you need help, please visit the HMAA Customer Service Center for assistance or call 808-591-0088, or toll-free 1-800-621-6998.

Free Telehealth Service through HiDoc:

If you need care for a non-life threatening condition or mental health support and are having a difficult time accessing a provider, HMAA members can get care at no cost through the HiDoc telehealth service. In most cases you can be seen by a physician in as little as 30 minutes from your phone, mobile device, or computer. Call (808) 400-4113, visit HMAA.com/telemedicine, or download the HiDoc® Online mobile app.

Interisland Access to Care Program:

If care is not available on a HMAA member’s home island, HMAA will reimburse travel costs to the nearest island where care can be provided in accordance with the member’s plan benefits. Note: Travel associated with medical care will be based on HMAA’s regular plan benefits. Click here to learn more.

If you or your employee were injured and already have Aflac insurance coverage, please visit our Aflac Policyholders website to review your policy and how to file a claim.

[Added 9/1/23]

NEW BENEFIT AVAILABLE FOR PROSERVICE HAWAII 401(K) PARTICIPANTS

ProService Hawaii and Transamerica have received approval to add a provision under Secure Act 2.0 that allows participants who were affected by the Maui Wildfires to take a withdrawal from their ProService Hawaii 401(k) Multi-Employer plan. Here are key points to know about the distribution:

401(k) Qualified Disaster Recovery Distribution

- Allows a participant impacted by the Maui fire to take a penalty-free withdrawal from their ProService Hawaii 401(k) multiemployer plan of up to $22,000 and will not be subject to the following:

- 10% early distribution penalty for participants under the age of 59 ½

- Mandatory 20% federal tax withholding at the time of the distribution

- The Qualified Disaster Recovery Distribution provision permits:

- A distribution from amounts that would not otherwise be distributable from the plan.

- The distribution amount may be repaid over the following three-year period.

- It is up to the participant to claim income from the distribution within the following 3-year period.

- Any repayment amount made within the following 3 years back into the 401(k) plan will be treated as a rollover and not taxable.

- Any amount not paid back within the following 3 years will be treated as income and considered taxable.

- Any interested participants should contact Transamerica directly at 1 (800) 555-8888.

- This provision is available for 180 days after the Maui Wildfire disaster declaration date, or through 2/4/2024.

Furloughs, Layoffs & Unemployment

Advice and templates to help you navigate difficult scenarios and how employees can get unemployment assistance

We encourage affected businesses to let employees know they can begin filing for unemployment benefits with the State of Hawaii. The best way to file a claim is online (https://labor.hawaii.gov/ui/).

However, if internet access is an issue, claims can also be filed by phone. As of August 12th, the State has extended hours, seven days a week, from 7 am to 6 pm. Employees can call any of the four numbers listed here: (833) 901-2272, (808) 762-5751, (833) 901-2275, or (808) 762-5752.

If neither of these are options, claims can be filed in-person at a State unemployment office. Employees can visit the Maui Unemployment Insurance Office, which is located in Wailuku at the State Building at 54 South High Street, Room 201. They are accepting walk-ins, but we are advised that wait times may be lengthy. To file a claim in person, identification, such as a driver’s license, passport, or State ID card, is required. Photocopies will be accepted.

Overview:

Unemployment Insurance (UI) is a joint program of the federal and State governments. In Hawaii, it provides temporary cash benefits to workers who become fully unemployed or separated from their employer (e.g., layoffs) or partially/temporarily unemployed but attached to their employer (e.g., reduced hours, zero-hours furlough, etc.) through no fault of their own, and who meet the eligibility requirements as determined by the State.

Benefit Amount & Duration:

The State will calculate employees’ weekly benefit amount based on their wages. Full unemployment, usually the outcome of a layoff, pays up to a maximum of $763 per week, and employees can receive benefits for up to 26 weeks in the one year called a “benefit year.” Partial unemployment, usually the outcome of a furlough or working reduced or even zero hours, also pays a maximum of $763 per week. However, suppose an employee's earnings during the week equal or exceed their weekly unemployment benefit amount. In that case, they will not be entitled to unemployment benefits for that week.

Employee Eligibility for Benefits:

The State of Hawaii, Unemployment Insurance Division, will determine employees’ eligibility based on the following criteria:

- Prior wages: An employee must have earned sufficient wages in the 12 to 18 months prior to filing a claim.

- Separation reason: If unemployment is due to the Maui wildfires, an individual will qualify for UI benefits. Generally speaking, if a person becomes unemployed through no fault of their own, they are eligible for benefits.

- Ability and availability to work: The job search requirement to maintain eligibility is currently being waived by the State for employees impacted by the wildfires.

How Employees Can Apply:

Employees can file for unemployment benefits in the following ways:

- Online: Applying online is the preferred option (https://labor.hawaii.gov/ui/) If employees need assistance, they can read the instructions or watch the video about how to apply.

- By phone: If internet access is a challenge, employees can call any of the four numbers listed here: (833) 901-2272, (808) 762-5751, (833) 901-2275 or (808) 762-5752. As of August 12th, the State has extended hours, seven days a week, from 7 am to 6 pm.

- In-person: If filing online or by phone is not an option, employees can visit the Maui Unemployment Insurance Office (Wailuku at the State Building at 54 South High Street, Room 201). Walk-ins are accepted, but wait times will likely be high. To file a claim in person, identification such as a driver’s license, passport, or State ID card, is required. Photocopies will be accepted.

To apply, employees will need:

- Correct employer name

- Required Identification

- If applying online or over the phone – Social Security Number is required

- If applying in-person – A driver’s license, passport, or State ID is required (photocopies accepted)

- Contact info

- Valid email

- Dates of employment over the past 18 months

- Past employer’s names, addresses, and phone numbers

- Reason for separation

- Direct deposit info (account type, account, and routing number). In the state of Hawaii, having a direct deposit account is required to get paid

Notes about applying:

- Employers should not try to file on behalf of an employee. To process the claim, the State would still need to contact the employee to validate the information submitted, causing significant delays in the employee receiving benefits.

- If an employee has filed for unemployment benefits previously and their benefit year is still active, they will be directed to reactivate their current claim rather than filing a new initial claim.

- If an employee is furloughed but not working any hours, they can report “Temporary layoff – Partial claim” as the “Type of Separation” when they file a claim.

- Employees working reduced hours can report “Still attached” as the “Type of Separation” when they file a claim.

After Applying:

- Employees will receive benefits through direct deposit. At the time employees apply for benefits, they will be directed to provide their banking information.

- Unemployment benefits are taxable, but taxes are not automatically withheld. Employees may request withholding in their application for benefits.

- Employees do NOT need to register with HireNet and complete the job search requirement if employees are filing claims due to the wildfires. The state is waiving this requirement only for employees affected by the wildfires. However, the state instructs employees to answer the questions as follows (since answering “no” will hold up their claim)

- Did you post an online resume on HireNet Hawaii? YES

- Did you look for work? YES

- How many employers did you contact? 3+

- Are you keeping written records of your job contacts? YES

How Unemployment is Funded:

For most employers, unemployment benefits are paid from funds held by the State that have been collected from the employer via unemployment insurance tax. For self-financed employers (limited to non-profits who have applied to be self-financed), benefits are paid by the employer through reimbursement to the State.

Benefits paid due to the wildfires will not be charged to contributory employers.

Resources:

If the Maui wildfires have impacted your business, you may be considering reducing your business expenses. Furloughs and layoffs are two of the most common approaches.

- A furlough allows employees to retain their jobs during a temporary period, and in most cases, their benefits continue uninterrupted.

- A layoff involves the termination of an employee's employment due to factors affecting the business, such as a lack of work or financial constraints, and in most cases, employees no longer receive benefits.

Understanding the advantages and distinctions between a furlough and a layoff is crucial. This knowledge will empower you to make informed decisions that enable your business to endure challenging times and ensure fairness and respect for your employees.

Pro-tip: If you think your employees can return to work within approximately the next 2 months, furloughing employees (instead of laying them off) may be something to consider. Here is a sample furlough letter you can use.

A furlough is forced temporary unpaid leave. Furloughs help employers immediately reduce costs while simultaneously providing business continuity and competitiveness for when the market recovers. Because employees do not earn their regular wages during a furlough, they are usually eligible for unemployment benefits and it does provide some assurance of returning to work. Also, benefits are typically continued for furloughed employees.

Furloughs can be implemented in a variety of ways. Employers might furlough all employees or only non-essential staff or make different determinations for each department so long as these decisions are based on business needs and not discriminatory or protected factors. Depending on business needs, the length of the furlough might last one month, one week, or one day every week. Employers can specify an expected timeframe for furlough, although it is okay for this to change depending on business needs.

Pros:

- Employees generally get to keep their benefits.

- Your company reduces short-term costs while also avoiding costly hiring and training processes once the situation stabilizes.

- Employees can collect unemployment benefits.

Cons:

- Your company continues to pay expenses for employee benefits.

- Employees may find other employment during the furlough period.

Pro-tip: If you think your employees cannot return to work within approximately the next 2 months or are unsure, laying off employees may be the best route. Here is a sample layoff letter you can personalize if WARN rules don’t apply to you. If WARN rules apply to your business, use this layoff template instead. See below to learn more.

A layoff is a termination of employment due to insufficient work or funding. Employees subjected to a layoff bear no responsibility for the situation and are usually eligible for unemployment benefits. However, they normally no longer receive company benefits.

Pros:

- Your company does not have to continue paying for benefits.

- Employees can begin searching for their next job without the false hope your company will take them back.

Cons:

- Your company must find new employees when ready to rehire.

Note: In the event of a layoff caused by the Maui wildfires, employers will not be charged for unemployment costs under the Major Disaster proclamation effective 08/08.

If you’re considering layoffs, here are critical HR factors you should be aware of:

Final paychecks: Employers must pay all earned wages at the time of discharge (or no later than the next working day). If you are considering layoffs, please let your Service Team at ProService know so we can prepare final paychecks.

Health insurance: When an employee is laid off, their job-related benefits, including health insurance, are typically terminated at the end of the month. Generally, if your company employed 20 or more employees during the last year, employees are eligible for continuation of benefits through the Consolidated Omnibus Budget Reconciliation Act (COBRA). COBRA allows eligible employees and their dependents to continue the same group health insurance coverage they had while employed at their own expense. This coverage extension ensures that individuals and their families can maintain essential healthcare benefits during a period of job loss and transition. While COBRA coverage can be more expensive since the employer's contribution is no longer provided, it remains a crucial option, providing a bridge between employer-sponsored health insurance and the next employment opportunity or alternative coverage. If applicable, ProService will send COBRA information directly to employees. If COBRA is not applicable, employees may explore options at HealthCare.gov, a government website providing options for individuals to purchase health insurance on their own.

Notifying employees: The WARN Act (Worker Adjustment and Retraining Notification) helps ensure that employers give advance employee notice in cases of qualified plant closings and mass layoffs. WARN requirements don’t apply if your company employs less than 100 employees or is laying off less than 50 employees, and there is no required notice period prior to laying off employees. However, WARN requirements apply if your company employs at least 100 employees and has one of the following circumstances:

- You are closing a facility or discontinuing operations permanently or temporarily and adversely affecting at least 50 employees, not counting part-time workers, at a single site of employment.

- You are laying off at least 50 employees (not counting part-time workers), and these layoffs constitute 33% of the total active workforce at a single site of employment.

- You are reducing the work hours for 50 or more employees by 50% or more each month in any 6-month period.

Note: The WARN Act has exceptions to the normally required 60-day notice period when layoffs occur due to natural disasters or unforeseeable business circumstances. Under this exception, employers should give as much notice as possible, send notices to the employees' last known address, and post notices at the work site, if possible.

Now Open: Hawaii Disaster Recovery Jobs Portal

Website: disasterrecovery.hirenethawaii.com

Hirenet Hawaii has opened a new web portal that offers a complete set of employment tools for job seekers in Hawaii affected by disaster.

Jobseekers can search for employment opportunities create resumes, and training. Employers can find candidates and post jobs on the site.

Emergency & Support Services

Helpful links making an insurance claim, getting FEMA or SBA assistance, as well as medical and mental/emotional services available to the Maui.

If you haven't already, we recommend that you apply for FEMA assistance. We have FEMA guidance on this page and step-by-step instructions on how you and your employees can apply. Note: FEMA cannot provide money to people or households for losses already covered by insurance. If your business does not qualify for FEMA, they may refer you to the SBA.

FEMA:

Federal funding is available to affected individuals in Maui County. If you, your home, and/or your business were impacted, you may be eligible for disaster assistance. Assistance can include:

Note: FEMA cannot provide money to people or households for losses already covered by insurance. If you have not already contacted your insurance company to file a claim, please do this as soon as possible. Failure to file a claim with your insurance company may affect you getting grant assistance.

How to apply:

- Phone: Call 800-621-3362 to apply

- Mobile app: Download FEMA’s mobile app and apply on your device.

- Online: Visit www.DisasterAssistance.gov. Enter Maui in the search box. You will be redirected to a page showing Maui County as a declared county. It may take a few seconds for this page to load. There will be a button that says “Apply Now”. If you are applying for both home and business disaster assistance, this registration/application will cover both. The application takes ~20 minutes to complete. Click here to see step-by-step instructions

- In-Person:

- Kahului: 310 W. Ka’ahumanu Avenue, Kahului, HI 96732

- Upcountry Maui (Opened on 8/25): Mayor Hannibal Tavares Community Center (Lower Multipurpose Room) – 91 Pukalani Street, Makawao, HI 96768

What you need to complete your application:

- Social Security number (SSN) OR the SSN of a minor child in the household who is a U.S. Citizen, Non-Citizen National, or Qualified Alien

- Annual Household Income

- Contact Information (phone number, mailing address, email address*, and damaged home address)

- Insurance Information (coverage, insurance company name, etc.)

- Bank Account Information (if you qualify for financial assistance, the money can be deposited in your account)

Notable highlights:

- If you have insurance, you should file a claim with your insurance company prior to applying for FEMA assistance. FEMA cannot aid with losses already covered by insurance. If your insurance does not cover all your losses or is delayed, you may be eligible for FEMA assistance regarding your unmet needs.

- Your assistance will be determined by comparing your recorded essential losses and serious needs to the types of assistance available within FEMA programs and services.

- You may also be referred to the U.S. Small Business Administration (SBA) for low-interest disaster loans to further assist with your recovery.

Learn more about what to expect after you apply for FEMA

Resources:

- Upcountry Maui Disaster Recovery Center Opens Aug. 25

- Maui Residents Eligible for Transitional Sheltering & Critical Needs Assistance

- FEMA Opens First Disaster Recovery Center on Maui

- Hawaii Wildfires (DR-4724-HI)

- FEMA Individual Assistance Brochure

- Application checklist

- What to Expect When Applying for FEMA Assistance

- Next Steps after Applying

- Verifying Home Ownership or Occupancy

After applying for FEMA assistance, you may be interested in or referred to a SBA disaster loan. If interested or referred, we recommend completing the loan application as soon as possible. If approved, there is no obligation to accept a SBA loan, but this may provide additional financing options. In addition, if denied an SBA loan, the SBA will inform FEMA and you may be eligible for additional FEMA assistance.

SBA Disaster Assistance Loans:

SBA Recovery Center in Kihei:

The SBA has partnered with the Hawaii Technology Development Corporation and the Hawaii Small Business Development Center to open an SBA Business Recovery Center in Kihei, starting August 16th. SBA representatives will meet with each business owner to explain how an SBA disaster loan can help finance their recovery. They will answer questions about SBA’s disaster loan program, explain the application process, and help each business owner complete their electronic loan application. All services are provided for free.

Hours of operation: Monday-Friday, 8 am-5 pm, and Saturdays, 10 am – 2 pm.

Location: 590 Lipoa Parkway Building A, Suite 119 Kihei, HI 96753

The SBA offers the following types of loans:

- Home & Personal Property Loans up to $500,000 for real property repair/replacement and up to $100,000 for personal property repair/replacement, with interest rates ranging from 2.5%-8%, and repayment terms up to 30 years.

- Business Physical Disaster Loans up to $2 million to repair/replace real or business property and up to a 20% loan amount increase to mitigate future damage, with interest rates ranging from 2.375%-8% for non-profits, 4%-8% for businesses, and repayment terms up to 30 years.

- Economic Injury Disaster Loans up to $2 million in combination with a Business Physical Disaster loan, with potential deferred payments and interest rates below 4% for businesses unable to obtain other forms of credit.

- Military Reservists Economic Injury Loans generally up to $2 million when ordinary operating expenses are not met because essential employees are called to active duty as military reservists.

Loan amounts, interest rates and other terms and conditions are determined by the SBA based upon damage amounts, ability to obtain credit elsewhere, and financial needs of each business.

Deadlines:

- The deadline to apply for property damage is Oct. 10, 2023.

- The deadline to apply for economic injury is May 10, 2024.

Resources:

- SBA Disaster Loans

- Press release: SBA to Open Business Recovery Center in Kihei to Help Businesses Impacted by the Wildfires

- SBA Fact Sheet for the Maui Wildfires

- What You Need to Know: Maui County residents and businesses impacted by wildfires.

Contact Information:

- Website: www.sba.gov/disaster

- Phone: (800) 659-2955

- Email: [email protected]

If you have insurance, file a claim immediately with every insurance carrier (e.g., business property insurance, homeowners, automobile and boat insurance, etc.) you have, based on the information you have to date, including business interruption losses. To file a claim, contact your broker or insurance carrier.

Other tips:

- Collect information: Find out what information your broker or carrier needs to process and approve your claim. Often required are dates of fire damage, location, a detailed list of all damages / all inventory or possessions lost in the fire, replacement/repair estimates, and any injuries incurred.

- Review your policy: If you are unable to locate your policy, ask for a copy from your broker or carrier and understand the terms of your policy.

- Keep track of everything: Document the entire process as much as you can. Take pictures of the damage, and make a list of everything you lost in the fire. Get all estimates in writing. And keep notes on any communication with your insurance company. Using email to communicate is an efficient way to retain an ongoing record.

More resource:

Take advantage of available emotional support services to you and your teams. Here are a few resources:

- The National Alliance of Mental Health: The National Alliance of Mental Health is starting a Maui Strong support group. Meetings will be Aug. 19 and 26 at 10 a.m. via Zoom. To register, email: [email protected]

- HawaiiUTelehealth (HUT): HawaiiUTelehealth (HUT) is supported by the University of Hawaii John A. Burns School of Medicine (JABSOM), and the Hawaii/Pacific Basin Area Health Education Center (AHEC). HUT is offering free telehealth services for anyone affected by the Maui wildfires. Affected individuals can call (808) 375-2745. No health insurance is needed.

- Hawaii Cares: Hawaiʻi Cares is offering local crisis counselors. Call 808-832-3100 or 1-800-753-6879, or call/text/chat 988. After hour services are available.

- Department of Health Maui Community Mental Health Center: The DOH Maui Community Mental Health Center (CMHC) is offering crisis mental health services and expanding hours to those experiencing emotional or psychological distress as a result of the Maui wildfires. To receive emergency services, contact Maui CMHC at (808) 984-2150, email [email protected], or in person at 121 Mahalani Street in Wailuku. Clinic hours are Monday through Friday, 8:00 a.m. to 4:30 p.m. They will have expanded clinic hours on Saturday and Sunday to accommodate immediate needs from 8:00 a.m. to 4:30 p.m. After hours, contact Hawaiʻi CARES to speak to a local crisis counselor at 808-832-3100, 1-800-753-6879, or call/text/chat 988.

- Mental Health App for Kaiser Members: If you are a Kaiser member, Kaiser has a partnership with Ginger, a mental health app, that allows you to text one-on-one with an emotional support coach anytime, anywhere. Download Ginger now at kp.org/coachingapps/hi. After signing in to kp.org, Kaiser Permanente members can set up a Ginger account at no additional cost. 24/7 text-based emotional support coaching.

- Carelon Behavioral Health: Carelon Behavioral Health, a partner with HMSA, is offering free counseling services. Call 1-800-580-6934.

- Calm and Collective Therapeutics: Hawaii-based Calm and Collective Therapeutics is offering free counseling services for those directly impacted by the Maui wildfires.

- Mana Mental Health: Mana Mental Health is offering free individual counseling sessions for pregnant or postpartum moms. All offerings are private, individual sessions, either virtual (secure video link) or by phone with Dr. Kalena Lanuza, Family & Psychiatric Mental Health Nurse Practitioner & Certified Lactation Counselor. Call 971-251-2081 or email [email protected]

- LifeWorks (a MetLife EAP vendor): LifeWorks is providing their services at no cost to those affected by the wildfires on Maui, whether they are a MetLife/LifeWorks customer or not. Contact LifeWorks at 1-888-319-7819.

- Mental Health America: The Disaster Distress Helpline (DDH) is the first national hotline dedicated to providing year-round disaster crisis counseling. This toll-free, multilingual, crisis support service is available 24/7 to all U.S. and its territories residents experiencing emotional distress related to natural or human-caused disasters. Call or text 1-800-985-5990.

Maui Medical Center:

Maui Medical Center remains open to all patients in need of emergency medical care 24 hrs a day, 7 days a week. Located at 221 Mahalani St, Wailuku, HI 96793. Families looking for loved ones at our hospitals may call (808) 244-9056 (Maui Memorial Medical Center) or (808) 878-1221 (Kula Hospital) and provide a first and last name to verify the information.

Kaiser Permanente:

Click here to get the latest updates from Kaiser Permanente for Maui. Medical services in West Maui will be provided by Kaiser Permanente to members and non-members at no cost at the following locations in Lahaina:

- Mobile health vehicle at Lahaina Gateway Center – Provides first aid, pediatric services, and OB/GYN services. OB/GYN services begin August 14 and will be offered every Friday beginning August 18.

- First aid station at Hyatt Regency Lahaina, Lahaina Ballroom – Provides first aid services.

- First aid station at Napili Park – Provides first aid and pediatric services.

The following Kaiser locations are open:

- Maui Lani Medical Office: Monday through Friday, 8 a.m. to 8 p.m.; Saturday and Sunday, 8 a.m. to 5 p.m.

- Kihei Clinic: Monday through Thursday, 8 a.m. to 4:30 p.m. Friday, 8 a.m. to 4 p.m. Closed on weekends.

- Wailuku Medical Office: Monday through Friday, 8 a.m. to 5 p.m. Closed on weekends.

For prescription refills:

Members can visit kp.org/pharmacy or call 808-643-7979. Or, visit pharmacy locations at our Maui Lani or Wailuku medical offices.

Emotional health services:

If you are a Kaiser member, Kaiser has a partnership with Ginger, a mental health app, that allows you to text one-on-one with an emotional support coach anytime, anywhere. Download Ginger now at kp.org/coachingapps/hi. After signing in to kp.org, Kaiser Permanente members can set up a Ginger account at no additional cost.

- 24/7 text-based emotional support coaching

- Discuss goals, share challenges, and create an action plan with your coach

- Self-care resources recommended for your needs

If you need to evacuate your current location due to the wildfires, please visit the nearest shelter to you on Maui:

- Hannibal Tavares Community Center (91 Pukalani St., Pukalani, Maui, HI 96768)

- Kihei Community Center (303 E. Lipoa St., Kihei, Maui, HI 96753)

- Maui Preparatory Academy (4910 HI-30, Lahaina, Maui, HI 96761)

- Maui High School (660 Lono Ave, Kahului, HI 96732)

- War Memorial Center (700 Halia Nakoa St, Wailuku, HI 96793)

The American Red Cross can also help you find the nearest shelter to you and provide more information on services provided at a shelter and what you should bring (and not bring). Family members can also reach out to local chapters the Hawaii Red Cross or their national Restoring Family Links number at 1-844-782-9441 for assistance in locating a loved one disconnected during the fires.

Maui United Way has opened the nonprofit grant application process for Phase 2 of its Maui Fire Disaster Relief program for four critical focus areas: keiki and young adults; mental health; stable housing; job training, education, and employment services. The deadline to apply is 5:00 pm HST on September 29, 2023.

The online application and more information is accessible at mauiunitedway.org/relieffunding.

How to Donate & Support Maui

Where to donate food and other necessities, online or in-person, to help Maui's communities impacted by the wildfires.

The Maui Food Bank is seeking monetary donations in efforts to feed thousands of displaced residents.

- Donations can be made online here.

- Maui Food Bank is asking to limit phone and email requests at this time. Instead, please consider donating online to help with disaster relief for Maui residents and families affected on Maui.

Maui United Way is accepting donations to its Maui Fire and Disaster Relief fund at https://mauiunitedway.org/disasterrelief.

Maui Humane Society says its animals are safe but needs to free up space to take in more displaced pets. Mainlanders and locals can:

- Drop off pet supplies to displaced families who still have their animals

- Donate money to help the shelter meet an increase in demand for care

- Report a lost or found pet here

- Call (808) 877-3680 for more information or visit their website

The Hawaiʻi Community Foundation started a Maui Strong Fund to support residents affected by the wildfires, which firefighting crews continue to battle in Lahaina, Pulehu/Kīhei and Upcountry areas.

- Donations can be made here.

Hawaii Salvation Army will start providing meals for thousands displaced in Maui emergency shelters.

- Hawaii Salvation Army is asking for monetary donations and large volume meal donations from restaurants and certified kitchens to aid in mass meal service at Maui shelters.

- Making monetary donations is the best way the public can help, Victor Leonardi, Divisional Director of Emergency Services & Safety for The Salvation Army Hawaiian & Pacific Islands Division, said.

- All money donated for disaster relief will go to disaster operations, Leonardi said.

- Donations can be made at Hawaii.SalvationArmy.org.

The Hawaii Restaurant Association is accepting donations to provide relief for Maui, such as food, water, medical supplies, and shelter.

ProService Client Partners Coming Together

See how our clients are helping Maui relief efforts. If you would like to add a service or have jobs available for employees who have been displaced, please fill out this form.

Your HR Partner in Crisis

At ProService, we are committed to serving the business community and standing as your pillar of strength during difficult times. If these wildfires have impacted your business, please know that we are here for you. Our team is prepared to offer guidance and support as you navigate challenges related to workforce management, employee well-being, and business continuity. Whether it's addressing payroll concerns, providing resources for mental health support, or assisting with HR-related matters, we are dedicated to helping you in any way we can.

Mahalo,

The Team at ProService Hawaii

Talk to Sales!

Learn how ProService's HR solution can help your business

Let’s set up a time to chat! Share your contact details and we’ll reach out to learn more about your business and answer any questions you have about our HR services.