- What We OfferOur bundled HR solution gives you a complete solution for

payroll, benefits, HR compliance and more.Withholdings, deductions,

direct deposit, and tax filings.Professional development, leadership and safety courses

Health insurance, 401(k)

plans, FSAs, and more!Professional development, leadership and safety courses

Hiring, onboarding,

handbooks, best practicesHiring, onboarding,

handbooks, best practicesCoverage, claims support,

safety programs - ResourcesBest practice advice for Hawaii

employersWatch our latest webinars,

get helpful guidesExpert articles and answers

to all your questionsTraining resources for our

client partners - About UsProService Hawaii helps

employers succed in HawaiiExplore our latest

company newsOur team is always

growing, come join us!We want to hear from you,

let us know how we can help.Discover how we’re

helping local companiesKnow someone that needs

HR support? Let us know.

Parking & Transit Accounts

A Parking & Transit Account can help you manage your work-related mass transit and parking costs. Save money by using tax-free dollars to pay for these expenses.

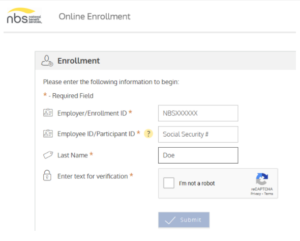

You’ll need your NBS Employer ID to enroll online. This information is available on your Open Enrollment instructions packet.

Click here to visit the NBS portal and follow these instructions:

1. Enter the NBS Employer ID number found on the Voluntary Benefits Options page of your open enrollment packet, then click “Submit”

2. Enter your social security number

3. Enter your last name

4. Click on “I’m not a robot”

5. Click on “Submit”

We’re here to help. If you have questions or need assistance with enrolling in your benefits, call the Open Enrollment Hotline at (808) 394-3118.

Why enroll in a Parking & Transit Account?

- Depending on your tax bracket, you could realize a tax savings of 15-30% on work-related mass transit and parking-related expenses

- Lower your IRS reported income which saves you money

A Parking & Transit Account allows you to use tax-free dollars to pay for monthly parking lot fees and mass transit programs (i.e. Bus Pass).

Unlike the Flexible Spending Account (FSA) plans, this program does not include a “use it or lose it penalty.” Any unused funds will carry forward to the next plan year in which you are an active participant.

You can use a Parking & Transit Account to pay for your share of expenses for commuting to and from work, reimbursable up to the monthly statutory or plan limit for:

Parking:

- Parking your vehicle in a facility that is near your place of work

- Parking at a location from where you commute to work (such as the cost of parking in a lot near to the bus station so you can continue your commute to work)

Mass Transit:

- Expenses include costs for any pass, token, fare card, voucher, or other item that entitles you to use mass transit for the purpose of traveling to or from work (i.e. Bus Pass)

Please check with either your employer or ProService Hawaii if you are eligible for this benefit.

Per IRS tax rules, the following are not eligible to participate:

- S Corp shareholders above the 2% ownership level and immediate family members

- LLC owners taxed as a Partnership

- LLP members

- Partners in a Partnership and Sole Proprietors; spouses/family members who are not W-2 employees of the company

You’ll need your NBS Employer ID number to enroll online. This information is available on the Voluntary Benefits Options page of your Open Enrollment instructions packet. Or, call ProService Hawaii at (808) 394-3118 to get your NBS Employer ID.

How to enroll online:

1. Click here to visit the NBS portal

2. Enter your NBS Employer ID number found on the Voluntary Benefits Options page of your Open Enrollment packet and click submit

3. Enter your social security number

4. Enter your Last Name

5. Click on “I’m not a robot”

6. Click “Submit”

7. Then you will be able to enter your enrollment information

You can submit claims to National Benefit Services (NBS) in the following ways:

- Online at my.nbsbenefits.com

- Use the NBS Benefits mobile app for Apple and Android devices;

- Submit an NBS Flexible Spending Account Claim Form with supporting documentation via email to [email protected], fax to 844-438-1496, or mail to:

National Benefit Services, LLC

P.O. Box 6980

West Jordan, UT 84084

Any remaining balance at the end of the year will rollover to the next plan year.

Yes, you can enroll/change/cancel your election on a month to month basis.

Your participation and salary deduction ends. You will no longer be able to incur expenses for reimbursement as of your termination date. You have 90 days from the date of termination to submit claims for expenses incurred prior to the termination date. Any balance left in the account after 90 days will be considered forfeit. You may choose to continue this coverage under COBRA.

Call the Open Enrollment Hotline

808-394-3118

Talk to Sales!

Learn how ProService's HR solution can help your business

Let’s set up a time to chat! Share your contact details and we’ll reach out to learn more about your business and answer any questions you have about our HR services.