- What We OfferOur bundled HR solution gives you a complete solution for

payroll, benefits, HR compliance and more.Withholdings, deductions,

direct deposit, and tax filings.Professional development, leadership and safety courses

Health insurance, 401(k)

plans, FSAs, and more!Professional development, leadership and safety courses

Hiring, onboarding,

handbooks, best practicesHiring, onboarding,

handbooks, best practicesCoverage, claims support,

safety programsDiscover how we’re

helping local companies - ResourcesBest practice advice for Hawaii

employersWatch our latest webinars,

get helpful guidesExpert articles and answers

to all your questionsTraining resources for our

client partners - About UsProService Hawaii helps

employers succed in HawaiiLearn about our upcoming events and community initiatives.

Our team is always

growing, come join us!Explore our latest

company newsKnow someone that needs

HR support? Let us know.We want to hear from you,

let us know how we can help.

Health Care

Flexible Spending Account

A Health Care Flexible Spending Account (FSA) can help you manage your medical costs. Save money by using tax-free dollars to pay for out-of-pocket health care expenses.

Why enroll in a Health Care FSA?

- Depending on your tax bracket, you could realize a tax savings of 15-30% on health care expenses

- Lower your IRS reported income which saves you money

Want to find out if you’re eligible or need more info? Get in touch with one of our benefits experts by clicking the button below and completing the form.

A Health Care Flexible Spending Account (FSA) is a voluntary benefit option that allows you to use tax-free dollars to pay for out-of-pocket health care expenses that you incur for yourself and your immediate family members. This benefit can be used to pay for expenses such as co-insurance, prescription medication co-pays, and other expenses that are not covered by your health, dental, vision, and drug insurance.

To determine if you’re eligible for this benefit, please check with your employer or contact the ProService Hawaii Voluntary Benefits Team at 808-394-4175.

Per IRS tax rules, the following are not eligible to participate:

- S Corp shareholders above the 2% ownership level and immediate family members

- LLC owners taxed as a Partnership

- LLP members

- Partners in a Partnership and Sole Proprietors; spouses/family members who are not W-2 employees of the company

The ProService Hawaii Voluntary Benefits Team can assist you with the steps in enrolling in this benefit. Please call us at 808-394-4175 or click here to submit an online request.

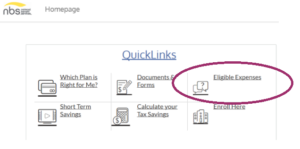

Go to my.nbsbenefits.com. Under the QuickLinks section at the bottom of the page, click on Eligible Expenses and you’ll find tools like an eligibility list and FSA calculator that can help you estimate how much you can save with FSA.

You can submit claims to National Benefit Services (NBS) in the following ways:

- Online at my.nbsbenefits.com

- Use the NBS Benefits mobile app for Apple and Android devices;

- Submit an NBS Flexible Spending Account Claim Form with supporting documentation via email to [email protected]; fax to 844-438-1496 or mail to:

National Benefit Services, LLC

P.O. Box 6980

West Jordan, UT 84084

The plan will automatically rollover up to $500* in your FSA account for use in the next plan year. Any amount in excess of the $500 will be forfeited.

There is a run out period between January 1 – March 31 to file claims for services rendered in the previous calendar year. This means you will have until March 31, 2022 to file claims for services rendered in 2021.

*Note: The rollover amount will vary depending if your employer opted to increase this amount per IRS cost of living adjustments.

Changes can only be made within 30 days of a qualifying event and will take effect on the first of the following month. The IRS determines what is considered a qualifying event or qualified change of status. Some examples of qualified changes are birth of child, death, divorce, or marriage.

Your participation and salary deduction ends. You will no longer be able to incur expenses for reimbursement as of your termination date. You have 90 days from the date of termination to submit claims for expenses incurred prior to the termination date. Any balance left in the account after 90 days will be considered forfeit. You may choose to continue this coverage under COBRA.

WE'RE HERE TO HELP

For assistance with your voluntary benefits, please contact us between Monday – Friday, 8am – 5pm.

Talk to Sales!

Learn how ProService's HR solution can help your business

Let’s set up a time to chat! Share your contact details and we’ll reach out to learn more about your business and answer any questions you have about our HR services.