- What We OfferOur bundled HR solution gives you a complete solution for

payroll, benefits, HR compliance and more.Withholdings, deductions,

direct deposit, and tax filings.Professional development, leadership and safety courses

Health insurance, 401(k)

plans, FSAs, and more!Professional development, leadership and safety courses

Hiring, onboarding,

handbooks, best practicesHiring, onboarding,

handbooks, best practicesCoverage, claims support,

safety programsDiscover how we’re

helping local companies - ResourcesBest practice advice for Hawaii

employersWatch our latest webinars,

get helpful guidesExpert articles and answers

to all your questionsTraining resources for our

client partners - About UsProService Hawaii helps

employers succed in HawaiiLearn about our upcoming events and community initiatives.

Our team is always

growing, come join us!Explore our latest

company newsKnow someone that needs

HR support? Let us know.We want to hear from you,

let us know how we can help.

72% of employers say health benefits costs are rising...

What Can Hawaii Employers Do? 4 Actions You Can Take

#1.

Understand Why Healthcare Costs Are Rising

Discover how market factors put pressure on businesses when it comes to employer-sponsored healthcare costs and persistent recruiting challenges. Get valuable tips on optimizing your healthcare offerings to effectively balance both challenges.

#2.

Start Open Enrollment Planning Now

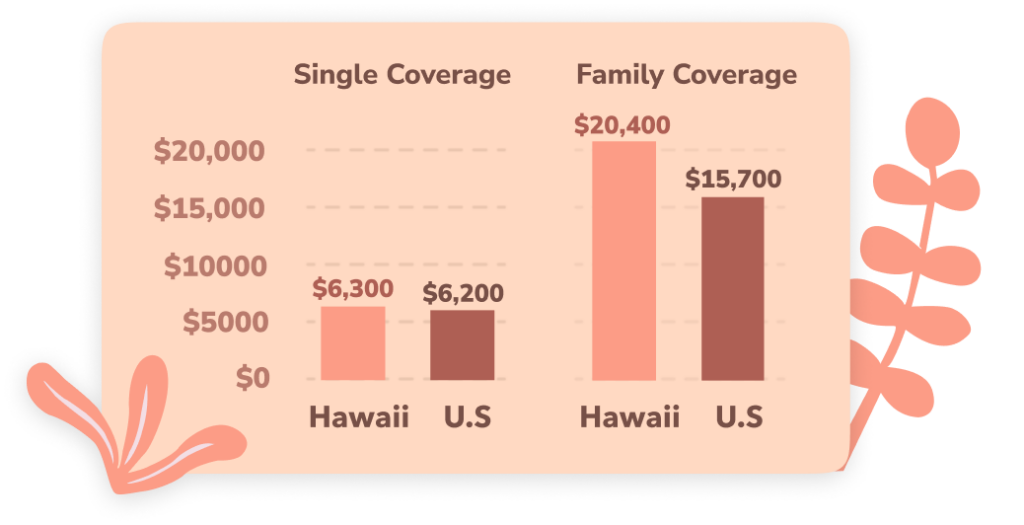

Hawaii employers face an average cost of $6,300 per employee for single coverage and over $20,400 for family coverage per year. These figures surpass national average cost for single ($6,200) and family ($15,700) health plans. Now is the time to start dialing into health insurance costs and employee needs before your open enrollment period begins.

#3.

Learn How to Build a Great Employee Benefits Package

If it’s been a while since you’ve reviewed your offering, now may be the time to revisit your benefits strategy and explore your options. Learn about Hawaii's unique healthcare requirements, benefits top local companies are offering, and what low-cost, no-cost benefits are available to help you retain top talent.

#4.

Talk to ProService Hawaii. Learn How We Help Companies Like Yours

Have you considered leveraging the bulk-buying power of a PEO to help contain your employee healthcare costs? Schedule a consult with one of our business consultants to learn why we're the HR provider of choice in Hawaii and how we can help you contain your labor costs.

Talk to Sales!

Learn how ProService's HR solution can help your business

Let’s set up a time to chat! Share your contact details and we’ll reach out to learn more about your business and answer any questions you have about our HR services.