- What We OfferOur bundled HR solution gives you a complete solution for

payroll, benefits, HR compliance and more.Withholdings, deductions,

direct deposit, and tax filings.Professional development, leadership and safety courses

Health insurance, 401(k)

plans, FSAs, and more!Professional development, leadership and safety courses

Hiring, onboarding,

handbooks, best practicesHiring, onboarding,

handbooks, best practicesCoverage, claims support,

safety programs - ResourcesBest practice advice for Hawaii

employersWatch our latest webinars,

get helpful guidesExpert articles and answers

to all your questionsTraining resources for our

client partners - About UsProService Hawaii helps

employers succed in HawaiiExplore our latest

company newsOur team is always

growing, come join us!We want to hear from you,

let us know how we can help.Discover how we’re

helping local companiesKnow someone that needs

HR support? Let us know.

Your Complete Guide to Open Enrollment 2024

We're here to make open enrollment as easy as possible for you.

Browse our online guide to get more resources.

Step 1: Check your Email

You will receive an email with the subject line “[Action Required] Select your offerings for Open Enrollment 2024”. It will include your company's open enrollment packet.

Step 2: Keep Comparable or Change

Do you want to offer benefits comparable to last year?

Are your employees content with your current benefit offerings?

If YES – It’s easy to keep your comparable plans for next year. Go back to the email, click on the Keep Comparable button, confirm, and you’re done!

If NO – Means you’re looking to change your current offerings. Please contact us by replying to the email with your packet, or call the Open Enrollment Hotline at 808-394-3118 for assistance.

Sleep at night knowing ProService has you covered.

Best Value in Hawaii

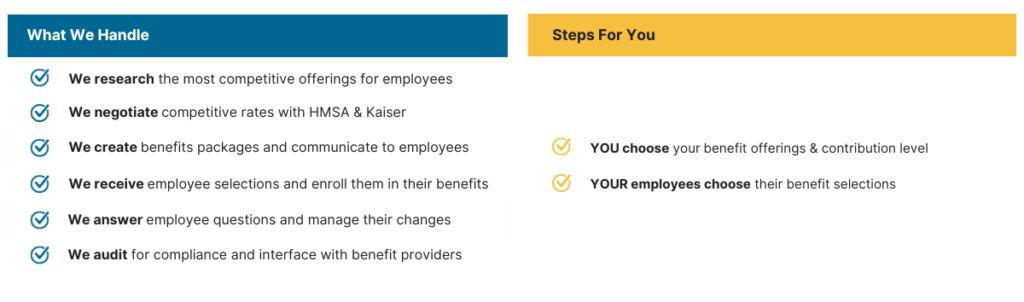

With 2,500+ local employers in our ohana, we leverage our size and negotiate the best cost for you. We research the market and compare plans, saving you time and money.

Strong Kaiser & HMSA Partnerships

We partner with the largest healthcare and benefit providers to help you access comprehensive and affordable benefits, without the administrative burden.

Cost-Savings Over Time

Our healthcare program has lower fixed costs and helps you achieve more stable rates than other providers over time. Our clients save ~$5,000+ per employee on healthcare over 10 years.

Open Enrollment Basics

During open enrollment, as the employer, you have the opportunity to review employee health care and voluntary benefit offerings for the coming year.

You’ll receive plan and rate options and decide whether to keep your current offerings or make changes that suit your needs. It’s also an opportunity for your employees to adjust their coverage based on their needs.

Give these questions some thought:

- Do you want to offer benefits comparable to last year?

- Are your employees content with your current benefit offerings?

These questions will help you decide if you should keep your offerings the same, or make changes. No matter what you decide to do, you can be extra confident that you have the most competitive rates in the market.

Communicate with your employees early. Once you’ve selected your plans, let your employees know about their upcoming open enrollment. Make sure they know that their selection is important—e.g. barring a qualifying event such as marriage, divorce, or the birth or death of a child, they'll have to stick with the options they select until the next open enrollment period.

Make sure ProService has the correct home mailing address for your employees. We will be mailing Open Enrollment communication to your employees’ home address on file.

Please ask your employees to make sure ProService has their correct home mailing address to minimize disruption in communication. If their home address needs to be updated, have your employees contact the Employee Service Center at 808-394-4162.

ProService will send an email with your Open Enrollment Packet to your company’s designated open enrollment contact.

For questions about Open Enrollment or assistance in making your selection, here’s how to contact us:

- By Email: Reply to the email containing your open enrollment packet or send an email to [email protected]

- By Phone: Call our Open Enrollment Hotline at 808-394-3118 between Monday – Friday, 8am-5pm and one of our benefits experts will assist you.

EMPLOYEE INFORMATION

After you (the employer) complete your benefits selection, it's your employees' turn to select their health care and/or voluntary benefits for the coming year.

This year, ProService will mail your employees’ open enrollment letters via US Postal Service directly to their home address on file. Please share this information with your employees.

If your employees need to update their home mailing address, or have questions about open enrollment or their benefits, please have them call the Employee Service Center at 808-394-4162.

ProService will mail employees’ open enrollment letters via US Postal Service directly to their home address on file.

If your employees need to update their home mailing address, or have questions about open enrollment or their benefits, please have them call the Employee Service Center at 808-394-4162.

Please check your email and open enrollment packet for your selection due date.

If you’d like to offer comparable benefits to your employees for next year, simply click the blue Keep Comparable button on the email containing your packet, confirm, and you’re done!

If you need assistance in making your selection, please contact us to request a consultation:

- By Email: Reply to the email containing your open enrollment packet or send an email to [email protected]

- By Phone: Call our Open Enrollment Hotline at 808-394-3118 between Monday – Friday, 8am-5pm and one of our benefits experts will assist you.

Health insurance premiums are expected to increase annually based on your group's claim history and risk profile, and inflation for health care costs. With ProService as your HR partner, you can feel confident knowing that we go the extra mile to obtain the most competitive rates in the local market for our clients.

Two things happen during Open Enrollment:

You, the employer, selects the offerings for your employees. This is the one time a year when you decide to either keep your current offerings, or select new options that better serve your business’ and employees’ needs for the coming year.

Then, your employees choose their benefits. After you select what you want to offer your employees, they get the opportunity to choose their benefits. That means they can keep their comparable plans, switch, add a dependent, or opt-out if needed.

Circumstances change, for providers, employers, and employees too. Open enrollment occurs annually to allow all parties to make changes to their benefits based on current needs.

- Providers: On the provider side, open enrollment is the time to make sure plans are staying compliant with new local and federal rules and regulations. It's also a time to adjust prices for inflation and reassess risk.

- Employers: For employers like you, open enrollment is your chance to look at how your organization may have changed in the past year and adjust your offerings accordingly. For example, if you added a new layer of management this year, you may want to review and adjust your benefit groups.

Employees: Finally, open enrollment is also a time when employees can reassess their own needs, and select the plans and coverage that makes the most sense for them and their families. They’ll have the opportunity to switch plans, add a dependent, or opt-out if needed. Note: If an employee chooses to waive health care coverage, they’ll need to submit a 2024 HC-5 waiver along with proof of valid health care coverage for the coming year.

Healthcare Benefits

The federal government requires employers to provide health insurance for some employees, but Hawaii’s laws go even further. Under the Hawaii Prepaid Health Care Act, employees who work at least 20 hours per week for four consecutive weeks are eligible for health insurance coverage by their employer.

However, a few groups are excluded from that requirement. This includes insurance and real estate salespeople paid on commission, seasonal agricultural workers, and people working for family members. Once employees become eligible for coverage, benefits kick in on the first day of the following month.

If an employee chooses to opt-out of their employer’s health insurance (e.g. if their insurance is already being covered by a spouse), they need to fill out an HC-5 form every year and provide valid proof of health care coverage.

At this time, the 2024 HC-5 Form is not yet available. We will update this FAQ when it is released by the State Department of Labor.

Refer to the Health Care Fees page of your packet to view a list of the health care plans available to your employees.

It’s OK if your employee wants to opt-out of their health care benefits (e.g. if their insurance is already being covered by a spouse).

However, they need to complete and submit a new HC-5 form every year that they choose to opt-out, along with valid proof of health care coverage. We will include a copy of the HC-5 form in your employees' open enrollment instruction letters to make it easy for them to complete should they select to opt-out.

At this time, the 2024 HC-5 Form is not yet available. We will update this FAQ when it is released from the State Department of Labor.

Employees can sign up for, or make a change to their health insurance benefits after they complete the initial eligibility period, or during their employer’s annual open enrollment period.

Outside of those eligibility windows, they can change or sign up for a plan within 30 days of a significant life event, like marriage, divorce, the birth or adoption of a child, the death of a covered family member, or a change in a spouse’s work status that affects benefits coverage.

One of employees’ biggest concerns is how much their health insurance is going to cost. In general, employees share the cost of health care services with their employer and the plan they select. But it’s not always a simple equation. There are several different costs that go into the total expense of health care. Let’s break them down:

- Monthly Premium. This is the monthly fee for your health insurance plan. In Hawaii, the employer must pay at least half of the premium, as long as the employee’s share of the cost is no more than 1.5% of their wages.

- Deductible. This is the amount you must pay out-of-pocket before your insurance plan kicks in and starts to cover the cost of your medical services.

- Copay. A copay, or copayment, is the predetermined fee you have to pay for certain services or medical visits. Copays do not count toward your deductible, but they do count toward your out-of-pocket maximum.

- Out-of-Pocket Maximum. The out-of-pocket maximum is a cap on the total amount you will have to pay on medical bills in a calendar year. Once you reach the cap, your insurance provider will cover 100% of your medical costs from then on.

- Coinsurance. This is the insurance company’s share of your medical bill (after your deductible has been met). If your plan provides for 80% coinsurance, that means your insurance provider will pay for 80% of the cost, and you’ll be responsible for the remaining 20%.

- Care not covered by insurance. Also referred to as “exclusions” by health care carriers. If a test, procedure or medication is not covered by your insurance plan, you may need to pay for it yourself.

Here is a list of terms you may come across during Open Enrollment:

- 1.5% Option: In accordance with the Hawaii Prepaid Health Care Act, employers may require employees to pay 1.5% of the employee's gross monthly wages, not to exceed 50% of the Health Care Fees for single coverage of the base health plan.

- Additional Health Plan Offerings: If your Base Health Plan is an HMSA plan, you may choose to offer Kaiser as well, or vice versa. Employees will be responsible for any additional costs for these options.

- AM: AM stands for Acupuncture and Massage.

- Base Coverage: Base Coverage is the coverage level selected as part of the Employer Paid Base Health Care Offering for a particular benefit group. You can select the Single option or Other (e.g., Employee + Child(ren), Employee + Spouse, or Family).

- Base Health Plan: The Base Health Plan is the health plan selected as part of the Employer Paid Base Health Care Offering for a particular benefit group.

- Base Riders: Base Riders are the rider(s) selected as part of the Employer Paid Base Health Care Offering for a particular benefit group. In addition to medical only, you can choose to add drug, vision, and dental coverage to your base health plan.

- Benefit Group: A Benefit Group is used to distinguish different health plan offerings for different employee groups within a company (for example, Primary Staff vs. Managers). State and federal laws dictate how employers can designate these benefit groups.

- Client Authorized Health Plan Selection Signature: The Health Care Offering Selection Form must be signed and submitted by an individual authorized to make health plan decisions on behalf of your company.

- Comparable Health Care Offering: ProService strives to provide you and your employees with the best health plan options available, which means changes in our overall offering year to year. By selecting the Comparable Health Care Offering(s) you are opting for the available plans and benefit group structure that most closely resembles what you currently offer your employees.

- Employer Paid Base Health Care Offering: As mandated by Hawaii’s Prepaid Health Care Act, employers must pay for a medical plan (at minimum) for eligible employees. Employers can choose to cover additional riders, such as drug and dental, or additional coverage, such as family coverage. The Employer Paid Base Health Care Offering defines what type of health plan, riders, and coverage level you are choosing to provide for a particular benefit group.

That depends on your carrier.

- If you are an HMSA member, you will receive a new medical insurance card in January.

- If you are a Kaiser or HDS member, you will not receive a new insurance card.

If you're not changing your health plans, your subscriber number will remain the same and you can use your current cards until the new ones arrive.

For more information, download this helpful FAQ sheet on Medical Insurance Cards.

Yes. Your health care coverage for the coming year is effective January 1, even if you don't receive your new cards by then.

For more information, download this helpful FAQ sheet on Medical Insurance Cards.

There are 3 ways to get a copy of your insurance card:

1. Online Self-Service. Register for an account on your carrier's website (see links below) and download your insurance card from the web.

- For HMSA: Go to hmsa.com and click on Member Login to get started.

- For Kaiser: Go to kp.org/registernow and create your account.

- For HDS: Go to hawaiidentalservice.com/hds/registration to register.

2. Contact the ProService Employee Service Center at 808-394-4162 for assistance. Please allow 7-10 days to receive your new cards after reordering.

3. Contact your carrier directly:

- HMSA Customer Service: (808) 948-6079

- Kaiser Hawaii Customer Service: 1-800-966-5955

- HDS Customer Service: 1-844-379-4325

For more information, download this helpful FAQ sheet on Medical Insurance Cards.

Voluntary Benefits

Voluntary benefits, also known as supplemental insurance or employee-paid benefits, are extra benefits added to an employer’s core employee benefits.

Many employers have been offering voluntary benefits for years, traditionally in the form of supplemental medical insurance e.g. critical illness, cancer care, accidental injury. Other products protect employees’ financial well-being, like 401(k) retirement plans, flexible spending accounts, and life insurance. Think of voluntary benefits as complementary to traditional health care.

- Flexible Spending Accounts (FSA): Help your employees get more for their money by giving them the option to set aside pre-tax funds to pay for eligible out-of-pocket health and dependent care expenses. Click to learn more about Health Care FSA and Dependent Care Account.

- Pre-Tax Transportation Plans: Relieve commuter stress for your employees by giving them the option to set aside pre-tax dollars to pay for eligible work-related expenses like monthly office parking, public transportation or vanpools.

- 401(k) Retirement Plan: Help your employees save for their future by offering a rich 401(k) retirement plan that gives them maximum pre-tax benefits at the lowest cost and access to top funds that are typically not available to smaller employers.

- Student Loan Repayment Assistance: Attract and retain college-educated workers by offering a Student Loan Repayment Assistance program. With easy set-up and flexible contribution amounts, you can easily support your people while growing trust, loyalty, and improving retention too.

- Voluntary Insurance: Give your employees access to supplemental health care options that complement your employer-provided health plans. Help your team protect themselves and their loved ones with affordable coverage. We offer the following voluntary insurance options from Aflac and Transamerica Life:

- Critical Illness

- Supplemental Dental

- Accident Insurance

- Short-term Disability Insurance

- Specified Health Event Insurance

- Cancer Specified-Disease Insurance

- Hospital Confinement Indemnity Insurance

If you’re interested in enhancing your employee benefits package with any of these voluntary benefits, please call us at 808-394-3118.

The pandemic has been a wake-up call for many, especially when it comes to financial security, and voluntary benefits can help your employees cover unexpected expenses.

Here are some stats from the 2021-2022 Aflac Workforce Report that support the importance of voluntary benefits:

- 70% of employers reported the voluntary benefits improve recruitment

- 75 of employers reported that voluntary benefits improve retention

- 51% of all American workers view supplemental benefits as a core component of a comprehensive benefits program.

- 1 out of 3 employees say voluntary benefits is more important now due to the pandemic.

- 46% of employees reported that they couldn't pay $1,000 or more for unexpected out-of-pocket expenses without relying on debt or credit

With the extremely competitive labor market we’re in, employers are doing everything they can to attract and retain employees. This means offering an attractive lineup of voluntary benefits, which could be a game-changer for your organization.

With the extremely tight labor market, offering additional benefits in addition to health care coverage can differentiate your business to attract and retain talent.

Voluntary benefits can open the door for you to:

- Offer your employees real value, at little to no cost.

- Meet employees’ health and financial well-being with additional layers of safety, security, and protection.

- Differentiate yourself from other employers in order to retain workers, and attract new ones.

- Build loyalty and goodwill amongst employees.

As the employer, you must first select which voluntary benefits to include in their employee benefits package.

Then, during your employees’ open enrollment, they have the option to enroll in the voluntary benefit options you’ve selected for them. Employees may pay for these benefits partially or in full through payroll deferral.

Call the open enrollment Hotline

808-394-3118

Talk to Sales!

Learn how ProService's HR solution can help your business

Let’s set up a time to chat! Share your contact details and we’ll reach out to learn more about your business and answer any questions you have about our HR services.