- What We OfferOur bundled HR solution gives you a complete solution for

payroll, benefits, HR compliance and more.Withholdings, deductions,

direct deposit, and tax filings.Professional development, leadership and safety courses

Health insurance, 401(k)

plans, FSAs, and more!Professional development, leadership and safety courses

Hiring, onboarding,

handbooks, best practicesHiring, onboarding,

handbooks, best practicesCoverage, claims support,

safety programs - ResourcesBest practice advice for Hawaii

employersWatch our latest webinars,

get helpful guidesExpert articles and answers

to all your questionsTraining resources for our

client partners - About UsProService Hawaii helps

employers succed in HawaiiExplore our latest

company newsOur team is always

growing, come join us!We want to hear from you,

let us know how we can help.Discover how we’re

helping local companiesKnow someone that needs

HR support? Let us know.

Employer's Guide to Coronavirus

Thanks for checking out our Employer's Guide to Navigating COVID-19! We are no longer updating this page but if you need links to key resources, see below.

Key Local Links

- Information and Resources for Managing COVID-19, Hawaii Department of Health

- Information for Getting Your Vaccine or Booster, Hawaii Department of Health

Key National Links

- COVID-19 Guidance for Specific Settings, Centers for Disease Control and Prevention

- Vaccines for COVID-19, Centers for Disease Control and Prevention

Recent Updates

- Ben Godsey: Why We as Employers Need to Drive Vaccinations

- Guide: A Better Way to Reward Employees

- Ultimate Vaccine Resources

- The Ultimate Guide to Vaccines & the Workplace

- On-Demand: Hiring & Retaining in a Tight Labor Market

- On-Demand: Recoup Thousands with the Employee Retention Credit for 2020

- Ben Godsey: The Pendulum is Swinging the Other Way

- Update on FFCRA: New guide and request forms

- Status of COVID-19 Vaccines in Hawaii

- Ben Godsey: A Big Win for Hawaii & Our Recovery

- Recoup Thousands with the Employee Retention Credit for 2020

- Unlocking PPP 2.0 and the COVID Relief Stimulus

- What's in the $900 Billion COVID Relief Bill?

- Update from the Experts: PPP

- Maximizing Loan Forgiveness: Understanding the Flexibility Act

- PPP Loan Forgiveness

- Business Planning Webinar

- Families First Coronavirus Response Act

- Save Hawaii Businesses (A Panel Discussion)

- CARES Act: Navigating Laws, Loans, and Layoffs

- Talk Story with Ed Case & Ben Godsey

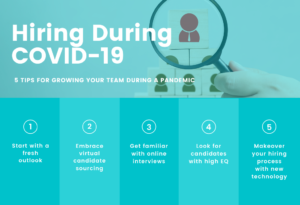

- Hiring & Retaining Workers in a Tight Labor Market

- Updates from the Experts: HR Practices and Policies for an Evolving Workforce

- Updates from the Experts: COVID-19 Workplace Scenarios

- What's Working? What's Not? What's Next For Your Favorite Restaurant?

- Reopening & Operating Your Educational Program

- Work in the New Normal: A Training for Healthcare Employees

- Operating Your Construction Company

- Reopening Your Professional Office

- Working in the New Normal: A Training for Employees

- Reopening & Operating Your Restaurant

- Reopening and Operating Your Retail Business

- Recipes for Reopening

- The New Normal: How to Make a Comeback

- Reopening Your Business to Survive & Thrive

- Remote Work

- Ergonomics

- Lead & Empower Your Team Through A Crisis

- Making Tough Decisions Amidst Uncertainty

- Five Fundamental Components of Resilient Leadership

- Adopting a Growth Mindset

- Women Rising & Leading Through Crisis

- What Hawaii Businesses Need. Right Now.

- The Here & Now on Employee Wellbeing

- Caring for Your People in the COVID Storm

- Deep Dive with Mark Mugiishi

- Retail CEO Roundtable

- Deep Dive with Bill Tobin

- Deep Dive with Rich Wacker

- Non-Profit CEO Roundtable

- Retail & Restaurant CEO Roundtable

Executive Series

Expert Interview:

Leadership In Crisis In Our Community

Our experts continue the conversation of leading in crisis in our community and, importantly, caring for employees. From what Hawaii needs to how people can support the community.

- John Fink, CEO of Aloha United Way

- Janina Abiles, Director of HR & Safety Training

Women Rising & Leading Through Crisis

Hear our panel of women leaders discuss a range of topics on leading effectively during times of turbulence and unprecedented change.

- Laura Beeman, University of Hawaii

- Miki Hardisty, ProService Hawaii

- Allison Izu, Allison Izu LLC

- Moderator: Trini Kaopuiki Clark, Make-A-Wish Hawaii

What Hawaii Businesses Need. Right Now.

Hear from a panel of Hawaii's most vocal business leaders discuss the critical needs of local businesses big and small

- Micah Kane, Hawaii Community Foundation

- Paul Kosasa, ABC Stores

- Monica Toguchi Ryan, Highway Inn

- Ben Godsey, ProService Hawaii

- Moderated by Bill Dorman, Hawaii Public Radio

The Here & Now on Employee Wellbeing

Get practical advice and best practices on how to engage your employees and help them manage stress.

- Beth Whitehead, American Savings Bank

- Jackie Ingamells, Global HR Consultant

- Moderated by Janina Abiles, ProService Hawaii

Caring for People in the COVID Storm

Hear experiences, lessons learned, and best practices from leaders operating on the front line of the COVID storm.

- Tricia Medeiros, The Plaza Assisted Living

- Donna Schmidt, Urgent Care Hawaii

- Dr. Emmanuel Kintu, Kalihi-Palama Health Center

- Michelle Kim Stone, ProService Hawaii

- Moderated by Janina Abiles, ProService Hawaii

Deep Dive with Mark Mugiishi

We sat down with Mark Mugiishi, President and CEO of HMSA—to dig a little deeper into a safe reopening from the public health lens.

Timestamps

[0:57] HMSA Response during the pandemic

[3:32] Increase in mental health needs and our kupuna

[5:32] Public health and reopening the state

[7:42] Working with health system partners

[8:32] A potential for a resurgence

[10:02] Masks for Hawaii: Protecting our Island State

[12:00] Contact tracing and Viral Testing

[15:35] Innovations in health care

[18:46] Concluding thoughts for small business owners

CEO Roundtable (Episode 3)

Listen to our CEO panelist discuss how they are quickly adapting their go-to-market strategy following the governor's latest announcement.

- Carol Ai May, Simply Organized, City Mill Company, Ltd.

- Tanna Dang, Eden in Love

- Tina Yamaki, Retail Merchants of Hawaii

- Michelle Kirk, ProService Hawaii

CEO Roundtable (Episode 2)

Hear from our CEO panel on how they're managing and motivating their workforce while evolving their service delivery model amidst times of intense pressure.

- Dean Wong, Imua Family Services

- Kim-Anh Nguyen, Blood Bank of Hawaii

- Micah Kane, Hawaii Community Foundation

- Ben Godsey, ProService Hawaii

CEO Roundtable (Episode 1)

With PPP loans funding, all employers are deciding how best to use these funds. Hear two approaches from our CEO panel on how they're using their funds.

- Ed Schultz, Hawaiian Host

- Ed Sultan, Na Hoku

- Bill Tobin, Tiki's Bar & Grill

- Ben Godsey, ProService Hawaii

[1:10-2:30] Welcome Introductions

[3:25-9:18] The State of Business

[9:19-20:30] Immediate Priorities and Next Steps

[21:49-30:03] PPP Loan: Different Thoughts & Approaches to Funding

[30:10-32:33] Tips for Working with Your Team

[32:37-50:00] Planning for Re-Opening

[50:00-53:13] Q&A – What can businesses do if they’re dependent on tourism?

[53:16-56:25 ]Q&A – The role of retail & restaurant dialogue with state decision-makers?

[56:30-59:58] Q&A – How do you think reduced capacity from social distancing will impact overall volume in restaurants?

[1:00:00] Conclusion: We’re just beginning the reset for what the economy will look like next.

Coronavirus Basics

Find info on coronavirus and learn how to protect yourself and others

from spreading the virus.

Coronavirus (COVID-19) is a respiratory illness that can spread from person to person, according to the Center for Disease Control (CDC). The virus that causes COVID-19 is a novel coronavirus that was first identified during an investigation into an outbreak in Wuhan, China.

Resources:

- Preventing COVID-19 from spreading (CDC)

- Daily COVID-19 Updates (Hawaii Department of Health)

The most common symptoms of COVID-19 are: Fever, tiredness, dry cough. Some people may also have aches and pains, nasal congestion, runny nose, sore throat or diarrhea. These symptoms are usually mild and begin gradually.

Some people become infected but don’t develop any symptoms and don't feel unwell. As many as 25% of people infected with the new coronavirus may not show symptoms, the director of the Centers for Disease Control and Prevention warns,

Most people (about 80%) recover from the disease without needing special treatment. Around 1 out of every 6 people who gets COVID-19 becomes seriously ill and develops difficulty breathing. Older people, and those with underlying medical problems like high blood pressure, heart problems or diabetes, are more likely to develop serious illness. People with fever, cough and difficulty breathing should seek medical attention.

Resources:

- Symptoms of Coronavirus (CDC)

- People who are at higher risk for severe illness (CDC)

- More evidence indicates healthy people can spread coronavirus (Associated Press)

- Infected but feeling fine: The unwitting coronavirus spreaders (New York Times)

Update as of 5/18: Governor Ige announced the change of his previous “Safer At Home” order to “Act with Care” order as part of the his Eighth Supplementary Proclamation. Social distancing rules and safe practices must still be followed. The 14-day travel quarantine remains in place until the end of June.

Safety Signage Requirement for Businesses: Pursuant to the Governor’s proclamation on April 16, 2020, all essential businesses are required to post a notice on their doors for all employees and visitors. Here’s a poster you can use.

Resources:

- Mayor Caldwell's updated Emergency Order (7/7)

- Video of Governor Ige announcing “Act with Care” phase (5/18)

- Governor's Eighth Supplementary Proclamation, signed 5/18 (Office of Govenor Ige)

- COVID-19 Essential Business Health & Safety Poster (ProService Hawaii)

- View the latest covid counts in Hawaii (Hawaii Data Collaborative)

- List of ‘essential workers' (ProService Hawaii)

Governors across the nation are taking stronger action by issuing stay-at-home orders in their states. Stay-at-home requires people to stay inside as much as possible and only go out for necessary activities. Exceptions to the order are being made for essential work and services, grocery shopping, medical care and exercise (as long as strict social distancing guidelines are followed).

Update on 9/8: Honolulu Mayor Caldwell extended Oahu’s second Stay-at-Home order which began on August 27 through September 23. With this extension, parks and beaches will reopen but only for individual (solo) activities. Non-essential businesses will continue to be closed, restaurants can only offer takeout, and social activities of any type will continue to be banned. Read the FAQ’s for more information on permitted activities, essential and non-essential businesses, and more.

Resources:

Resources:

Oahu’s stay-at-home orders have begun and many businesses must once again navigate a closed economy to curb the spread of COVID-19.

As always, we’re here to help. As you pivot to respond and adjust, here’s a few topical pointers to keep in mind as you head into the next two weeks.

- Remind employees about unemployment. If you're reducing employees’ hours or putting them on furloughs, remind your employees they may be eligible for unemployment benefits. Share this link and remind them to re-certify each week. >> Share the Link

- Know when FFCRA applies. Amidst Oahu’s shutdown, new surge testing, and back-to-school season, knowing when employees are entitled to FFCRA paid sick leave or child care leave (and when they’re not) will be critical. >> Learn More

- You should not force employees to submit to COVID-19 testing, unless you’re in the healthcare industry or work with a vulnerable population. Instead, do your best to be flexible so that your employees can balance their children, families, and voluntary participation in surge testing. >> Get Guide

- Lastly, remember remote work best practices. Whether you’re thrilled to work from home or dreading it, remote work is our new reality for two weeks, so we need to make the best of it. Set-up your workplace, establish hours/breaks/boundaries, and don’t forget to get up and move. >>Get More Best Practices

We hope you find this helpful, we’ll share more shut-down survival tips throughout the next two weeks.

The best way to prevent illness is to avoid being exposed to the coronavirus. That’s why government officials are recommending that everyone practice social distancing measures at this time. Even if you are young, or otherwise healthy, you are still at risk and your activities can increase the risk for others. It is critical that we all do our part to slow the spread of the coronavirus:

- Work or engage in schooling from home whenever possible.

- Avoid social gatherings in groups of more than 10 people.

- Use drive-thru, pickup, take out or delivery options for food and grocery items.

- Avoid discretionary travel, shopping trips, and social visits.

- Do not visit nursing homes or retirement or long-term care facilities unless to provide critical assistance.

- Drop off food to family or loved ones, but do not gather socially

- Practice good hygiene by washing your hands, especially after touching any frequently used item or surface.

- Avoid touching your face.

- Sneeze or cough into a tissue, or the inside of your elbow.

- Disinfect frequently used items and surfaces as much as possible.

- Donate excess toilet paper, hand sanitizers or masks to essential businesses or healthcare facilities

Per CDC guidance, older adults and people who have severe underlying chronic medical conditions like heart or lung disease or diabetes seem to be at higher risk for developing more serious complications from COVID-19 illness. They should consult with their health care provider about additional steps they may be able to take to protect themselves.

Resources:

Health & Safety at Work

Learn how to handle employee travel, testing and how to prevent the spread

of coronavirus in your workplace.

Prevent the Spread

Employer Question:

I’ve been told that an employee socializes with his friends at restaurants frequently. His coworkers are concerned that he is not following social distancing and face covering practices. What can we do to ensure the employee is following social distancing and face covering practices when he is not at the office so that he does not bring COVID-19 into the workplace

Answer:

An employee’s off-duty conduct is generally off-limits for an employer to monitor or regulate unless there’s a reasonable relationship between an employee’s off-duty conduct and the employer’s business. In other words, the employer would have to show that the employee’s off-duty contact poses a direct risk to the employer’s business. In the above scenario, however, employers should be careful about assuming an employee is not following social distancing and face covering practices just because the employee eats at restaurants and should instead rely on daily self-certifications by the employee that he or she has not had close contact with someone testing positive for COVID-19 or is waiting for a test result, is not personally exhibiting any COVID-19 symptoms and is following all of the employer’s policies on social distancing, face covering, personal hygiene and cleaning and disinfecting while in the workplace.

If an employer learns of more specific information that an employee is not following social distancing and face covering practices off-duty, particularly if the employee works with high-risk individuals, given the current pandemic and that social distancing and face covering wearing is required under current state and county orders, an employer could ask the employee to quarantine at home for 14 days. Know, however, that if an employee’s health care provider is not the one advising the employee to self-quarantine, the employee will not qualify for FFCRA paid sick leave and the employer may have to pay for a portion of that time if the employee is exempt/salaried and already worked a portion of the work week before being ordered to quarantine for 14 days. Employers should also be sure to be consistent when asking employees to quarantine at home for 14 days to avoid any potential discrimination claims by employees.

Finally, even if employers are allowed to monitor an employee’s off-duty contact due to COVID-19 exposure/close contact concerns, it does not mean employers should do so. It could be difficult to consistently apply this practice and sending employees home for 14 days every time a concern is raised might create staffing and production issues for the employer. Also, employers could suffer unintended consequences such as low employee morale.

On Oahu, face coverings while indoors (commercial and residential buildings) is mandatory at all times, especially when engaging and interacting with customers, visitors or other employees. If the company’s policy is also to require face coverings to be worn indoors at all times if social distancing is not attainable, employers should repeat and enforce their face covering policy and discipline their employees accordingly for violating company policy and current county or state orders.

There are certain limited situations that an employee may be exempt from wearing a face covering indoors. If the employee has a recognized disability or has religious reasons for not wearing a face covering they may be exempt from the face covering requirement. Even then, however, the employee does not have an automatic exemption. Employers must discuss with the employee to see if there are any alternate and reasonable accommodations to wearing a face covering that will suffice to protect the employers and others.

As a private business owner, you can require customers or visitors to wear a face covering while on your property. We recommend taking the following steps to minimize disruption to your business by an anti-mask guest or confrontation with such a guest.

First, overly-promote your face covering policy. More awareness of your face covering policy may lessen customer and guests’ confusion of whether or not they must wear a face covering when visiting your business. Make your face covering policy signage abundant at entrances to your business. Post your policy on all of your social media channels to further notify your customers and guests. If you are confirming over email or text a meal reservation or order or a product that is ready for pick up to a customer, include in that email or text a reminder that face coverings are required when visiting your business.

Next, train all of your employees on all health and safety measures you are implementing at the workplace, including the face covering requirement. Your employees are more likely to better communicate the face covering policy to customers and visitors if they understand the health reasons behind the requirements. Also critical for your employees is training on how to politely request customers to wear a face covering. You may even want to consider providing disposable face coverings to customers. Sometimes customers may have simply forgotten to grab a covering so rather than the customer being irritated that he or she has to return home or to the car to grab a covering, by offering a free face covering to a customer you have diffused a potentially uncomfortable situation.

Finally, assign the right employee to communicate your face covering policy to customers and visitors entering your workplace. The best employee is one with a calm, patient and easy-going yet professional demeanor. For their own safety, employees should not argue with customers refusing to wear a mask or physically block customers from entering the premises and instead should know when to escalate the situation to a manager or security or law enforcement (if they feel physically threatened by a customer). Also, under the current county orders, individuals who cannot wear a face covering due to medical conditions or disabilities where the wearing of a face covering may pose a health or safety risk to the person are encouraged to wear a face shield instead. So for any customer claiming they are medically prevented from wearing a face covering, the designated employee should be comfortable with encouraging the customer to return wearing a face shield, or offering your other alternate services you have in place as an option, such as curbside service or online shopping and mail delivery.

1. Assess your employees’ exposure to risk

OSHA has divided workplaces and work operations into four risk zones, according to the likelihood of employees’ occupational exposure during a pandemic. These risk zones are useful in determining appropriate work practices and precautions.

- Very High Exposure Risk: Healthcare employees performing aerosol-generating procedures on known or suspected pandemic patients; Healthcare or laboratory personnel collecting or handling specimens from known or suspected pandemic patients.

- High Exposure Risk: Healthcare delivery and support staff exposed to known or suspected pandemic patients; Medical transport of known or suspected pandemic patients in enclosed vehicles.; Performing autopsies on known or suspected pandemic patients.

- Medium Exposure Risk: Employees with high-frequency contact with the general population (such as schools, high population density work environments, and some high-volume retail).

- Lower Exposure Risk (Caution): Employees who have minimal occupational contact with the general public and other coworkers (such as office employees)

Generally, you can assess your employees’ exposure to health risks by answering the following questions about their duties:

- Do employees have face-to-face contact with large numbers of people?

- Do employees spend time in work sites, like health care settings, where they may come into contact with ill people?

- Do employees handle materials that could be contaminated, like laboratory samples or healthcare waste?

Resources:

- Guidance on preparing workplaces for COVID-19 (OSHA)

- Hazard Recognition (OSHA)

- COVID-19 Standards (OSHA)

- Control and Prevention (OSHA)

2. Tell sick employees to stay home

Employees who report having a fever or an acute respiratory illness upon arrival to work or who become sick during the work day should be separated from others and immediately sent home. They should be fever free (100.4° F or below) for 72 hours without the use of fever-reducing or symptom-altering medicines before returning to work.

Consider the following:

- Communicate your policies to all managers and employees with the expectation that sick employees stay home.

- If possible, designate a separate area at your work site where sick employees can temporarily isolate. Use this space for those who become ill during the work day and are awaiting transportation to their home or to medical care.

- Do not wait for employees to provide a healthcare provider’s note to validate illness or to return to work if they are sick with acute respiratory illness. Many medical offices and facilities may be extremely busy and may not be able to accommodate within a timely manner.

Resources:

3. Implement Infection Control

- Place posters that encourage staying home when sick, cough and sneeze etiquette, and hand hygiene at the entrances to your workplace, in restrooms, and in high visibility locations.

- Remind employees to clean hands often with an alcohol-based hand sanitizer (60-95% alcohol based) or by washing for at least 20 seconds (two rounds of the “Happy Birthday” song).

- Provide tissues and no-touch disposal receptacles.

- Routinely clean and sanitize hands after visiting high-traffic areas like conference rooms or break rooms but also doorknobs, keyboards, remote controls, desks etc.

Resources:

- Stop the spread of Germs (CDC)

4. Follow strict social distancing guidelines

Social distancing is an intervention to increase the physical distance between people and reduce the spread of disease. Economists point out that social distancing is not only saving lives, but also protecting the much-needed workforce from being depleted due to unnecessary illnesses and deaths.

We want to take this opportunity to make ProService Hawaii’s position clear: social distancing is crucial to the survival of hundreds of thousands of people.

Here’s what you can do:

- Maintain a distance of +6 feet from others

- Stay out of crowded places

- Work from home if possible

- Avoid contact with people at higher risk for severe illness

- Stay home and isolate for 14 days after any travel

Pursuant to the Governor’s proclamation on April 16, 2020, all essential businesses are required to post a notice on their doors for all employees and visitors. Here’s a poster you can use.

Resources:

- COVID-19 Essential Business Health & Safety Poster (ProService Hawaii)

- Economic shutdown is estimated to save 600,000 American lives (Bloomberg)

- Coronavirus, Social and Physical Distancing and Self-Quarantine (John Hopkins Medicine)

Good news! The State has begun to ramp up vaccinations to qualified individuals in Phase 1C. People aged 65+ or with high-risk medical conditions are also eligible to receive the vaccine.

Due to high demand, Phase 1C essential workers have been updated to only include:

- Hotel and hospitality workers

- Foodservice workers

Employees in industries like housing, construction and communications that were on the initial priority list are excluded for now.

To learn more or get the latest about the state's plan, visit https://hawaiicovid19.com/vaccine.

Employee Travel

The general answer is yes if the employee is not in a “high-risk” category and there has not been a positive case in the workplace. Under the ADA, however, employers may have to make certain reasonable exceptions or accommodations, such as teleworking or leave, if the employee has a high risk of serious health complications related to COVID-19.

In addition, in certain limited situations, OSHA permits an employee to refuse to work or perform a specific task. Under OSHA’s general duty clause, employers must maintain a safe workplace and mitigate any health or safety hazards. Therefore, in the limited situation of a positive case in the workplace and actual exposure to a coworker testing positive for COVID-19, an employee could refuse to work if ALL of the following conditions are met:

- the employee asked the employer to eliminate the hazard and the employer failed to do so;

- the employee genuinely believes that an imminent danger exists;

- a reasonable person would agree with the employee that there is a real danger of death or serious injury; and

- the urgency of the hazard does not allow correction through OSHA’s regular enforcement channels, such as requesting an OSHA inspection.

Updated August 14, 2020:

In a nutshell, no. The novel coronavirus has spread to more than 100 countries and nearly every continent.

At this time, any person (visitor and resident) coming into Hawaii must undergo a 14-day quarantine upon arrival. If your employee is subject to this mandatory 14-day quarantine, your employee may be eligible for FFCRA paid sick leave if that employee is unable to work from home during this quarantine period.

Governor Ige also reinstated partial interisland quarantine as of August 11. Under this ruling, anyone traveling within Hawaii from one island to another, with the exception of those arriving on Oahu, will need to quarantine for 14 days.

For Business Travel

Employers should limit all business travel, especially to affected areas at this time, and provide reasonable accommodations such as video conferencing during the duration of the threat and heightened risk.

You should also monitor travel alerts from the U.S. State Department to seek objective guidance about the health risks posed by travel to specific areas.

For Personal Travel

You can’t force an employee to cancel their personal travel, but you can encourage them to visit the CDC’s Traveler’s Health Site to get the latest guidance and recommendations for those who intend on traveling.

Upon their return, advise employees to check themselves for symptoms and tell their manager immediately if they start to have symptoms. Promptly call a healthcare provider for assistance if needed.

Resources:

- Partial interisland quarantine reinstated 8/11 (KHON2)

- Travel advisories (State of Hawaii Department of Health)

- Traveler’s health (CDC)

- FAQs for travelers (CDC)

As of August 11, 2020, any person (visitor and resident) coming into Hawaii must undergo a 14-day quarantine upon arrival. If your employee recently traveled and is subject to this mandatory 14-day quarantine, your employee may be eligible for FFCRA paid sick leave if that employee is unable to work from home during this quarantine period.

Quarantine and Testing

Employer Question:

When can we require employees to get tested for COVID-19 and show proof of a negative test result before returning to work? Do we have to pay for the test? Do we have to pay the employees for the time it takes to get the test and wait for a negative result before they return to work

Answer:

Unless an employee exhibits any symptoms of COVID-19 or tells you that they have had close contact with someone testing positive for COVID-19, we do not recommend requiring your employees to get tested and show proof of a negative test result before returning to work. Both the Centers for Disease Control and Prevention (CDC) and the U.S. Department of Labor (US DOL) recognizes that requiring documentation or proof of a negative test may put an unnecessary burden on healthcare providers and resources during a pandemic, which makes it difficult for employees to get appointments. This in turn can lead to unnecessary delays when an employee is actually able to work.

Moreover, under the FFCRA, health care carriers will cover the cost of COVID-19 tests only if they are medically necessary. This means that if an employee’s healthcare provider does not order a test but employers require the test as a condition to work, the employer must likely pay for the test. This also means that the time that an employee awaits the tests results is not covered under FFCRA paid sick leave (because the test was not deemed medically necessary) therefore if the employee is an exempt/salaried employee, the employer may also have to pay the employee for the time it takes for the employee to get the test and wait for the results. (Employers do not have to pay non-exempt/hourly employees for any time if that employee did not perform any work).

Employer Question:

My employee traveled to the mainland and is currently quarantining at home for 14 days. We work with young children so want to be as safe as possible. Can I require my employee to get a COVID-19 test and provide proof of a negative result before returning to work?

Answer:

The same answer in the previous question applies to this situation. In addition, if your employee is taking FFCRA paid sick leave to cover his or her 14-day quarantine period and you still want to require a COVID-19 test, you must require all employees returning from leave to take a COVID-19 test, not just those returning from FFCRA paid sick leave. If you require a COVID-19 test for only employees returning from FFCRA paid sick leave, this could be interpreted as disciplining or otherwise discriminating against an employee who took FFCRA paid sick leave.

Employer Question:

My employee informed me that she has family members incoming from the West Coast and will be quarantining for 14-days with her. Does my employee also have to quarantine for 14-days

Answer:

Unless your employee’s family members or your employee begins to show any symptoms of COVID-19 during the family members’ quarantine period, your employee does not have to quarantine for 14 days.

Yes. While taking an employee’s temperature is a medical examination under the American Disabilities Act, given the community spread of COVID-19, employers may take an employee’s temperature. However, as a practical matter, an employee may have COVID-19 without having a fever so temperature checks alone are not the most effective preventative measures.

Updated 3/30/20:

You should send home employees who have tested positive, as well as any employees who’ve worked closely with that employee, for a 14-day period of time to ensure the infection does not spread. Essential workers can return to work if they self-monitor as follows:

Do – Take your temperature before work, wear a face mask at all times & practice social distancing in the workplace as work duties permit

Don't – Stay at work if you become sick, share objects used near face or congregate in break rooms or other crowed work spaces.

Before the employee departs, ask them to identify all individuals who worked in close proximity (three to six feet) with them in the previous 14 days to ensure you have a full list of those who should be sent home. When sending the employees home, do not identify by name the infected employee or you could risk a violation of confidentiality laws. If you work in a shared office building or area, you should inform building management so they can take whatever precautions they deem necessary.

The CDC also provides the following recommendations for most non-healthcare businesses that have suspected or confirmed COVID-19 cases:

- Close off areas used by the ill persons and wait as long as practical before beginning cleaning and disinfection to minimize potential for exposure to respiratory droplets. Open outside doors and windows to increase air circulation in the area. If possible, wait up to 24 hours before beginning cleaning and disinfection.

- Cleaning staff should clean and disinfect all areas (e.g., offices, bathrooms, and common areas) used by the ill persons, focusing especially on frequently touched surfaces.

- Employers should develop policies for worker protection and provide training to all cleaning staff on site prior to providing cleaning tasks. Training should include when to use PPE, what PPE is necessary, how to properly don (put on), use, and doff (take off) PPE, and how to properly dispose of PPE.

If employers are using cleaners other than household cleaners with more frequency than an employee would use at home, employers must also ensure workers are trained on the hazards of the cleaning chemicals used in the workplace and maintain a written program in accordance with OSHA’s Hazard Communication standard.

Simply download the manufacturer’s Safety Data Sheet (SDS) and share with employees as needed, and make sure the cleaners used are on your list of workplace chemicals used as part of the Hazard Communication Program.

Resources

Resources

Take the same precautions as noted above, as if the employee tested positive for COVID-19. Treat the situation as if the suspected case is a confirmed case for purposes of sending home potentially infected employees. Communicate with your affected workers to let them know that the employee has not tested positive for the virus but has been exhibiting symptoms that lead you to believe a positive diagnosis is possible.

Employee Leave & FFCRA Scenarios

Update on FFCRA (as of 4/23/21):

While initial employer obligations to provide FFCRA paid sick and family leave ended on December 31, 2020, the new American Rescue Plan Act allows employers to voluntarily provide FFCRA paid leave benefits beginning April 1, 2021 through to September 30, 2021, and receive tax credits for such paid leave as well. For the latest information, read our latest FFCRA Guide (Updated 4/23/21).

About FFCRA:

On March 18, 2020, President Trump signed into law the Families First Coronavirus Response Act (“FFCRA”). The FFCRA goes into effect on Thursday, April 1, 2020. The Act provides for free COVID-19 testing and paid sick, family, and medical leave for employees impacted by COVID-19 at companies with less than 500 employees. The Act also provides for additional funding for unemployment benefits and Medicaid and food security programs.

Employee benefit:

Under this new law, employees of companies with less than 500 employees are entitled to:

- Sick Leave: 80 hours of sick leave, regardless of whether or not the employee has accrued sick leave.

- Child Care Leave: 12 weeks of job-protected leave, a combination of paid and unpaid leave.

To request leave on the basis of the FFCRA, an employee should complete and submit a request form with their supervisor/HR manager as soon as possible. Here is a sample FFCRA Employee Request Form we have created for our clients and employees.

Resources:

- Instructions on using the FFCRA Employee Request Form (PDF, updated 4/1/21)

- Blank FFCRA Employee Request Form (PDF for ProService Hawaii, updated 4/1/21)

Employer Question:

My employee’s child will be on a “hybrid” or rotating learning schedule (combination of in-school learning and at-home distance learning). Can my employee take FFCRA leave for the time period that his/her child is distance learning

Answer:

If the school is operating at a reduced capacity to comply with social distancing guidelines resulting in the employee’s child having no choice but to receive distance learning, FFCRA leave is available on the child’s remote-learning days provided the employee needs the leave to actually care for their child during that time and no other suitable person is available to do so.

Employer Question:

An employee is not comfortable sending their child to school even though the school plans to reopen in August. The school has given parents an option to keep their children at home and participate in optional distance learning. Can my employee take FFCRA leave for the time period that his/her child is distance learning?

Answer:

No. Because in-person learning is available, the school is not considered closed or partially closed.

Employer Question:

My employee has requested PTO to travel outside of Hawaii, which means she will be subject to the state’s mandatory 14-day quarantine order. Teleworking is not an option for my employee and my company is not exempt from providing FFCRA leave. Is this employee entitled to FFCRA leave even though she knows she will have to stay home for 14 days after her trip? Can I deny her PTO request?

Answer:

We understand that the U.S. Department of Labor (US DOL) is reviewing this scenario due to the number of states implementing 14-day travel quarantine periods across the country. However, until the U.S. DOL issues further guidance on this question, your employee is likely entitled to FFCRA leave. Of course, if you have a PTO or vacation policy already in place that prohibits employees from being absent from work for more than a specific number of days and the requested leave time exceeds that established policy, then you can deny the employee’s PTO request. Remember that under the FFCRA, paid sick leave because of COVID-19 is in addition to any existing sick leave policy provided by employers as of March 18, 2020. Employers cannot change their sick leave policy to circumvent FFCRA.

No. Emergency Paid Sick Leave for this reason is limited to the time the employee is unable to work because he or she is taking affirmative steps to obtain a diagnosis (e.g., for time spent making, waiting for, or attending an appointment for a test for COVID-19). Once an employee receives a negative test result, he or she is no longer entitled to Emergency Paid Sick Leave.

Reopening & Running A Business In Crisis

Find helpful tips for reopening and running a business during a pandemic on topics

like business strategy, people management, safety, remote work, and more.

Planning for Reopening

Resources

GET READY TO RESET

A big reset is happening right now. Business today now requires new business models and revenue streams, new staff relations, new relationships with our business partners, suppliers, landlords, and customers. When things “finally get back to normal,” our “new normal” will look very different from what we’ve known it to be.

Anticipating and preparing for this new business environment will take a little innovation, some patience, and a whole lot of grit. It will likely include many of the innovations businesses today are developing to survive right now. The important thing to remember is to know what you can control, make intelligent decisions, and rise into a refreshed economy, prepared.

HAVE A PLAN

If you want to reopen, stay open, and win long term in this new normal, you will need a comprehensive roadmap for the recovery marathon ahead. Whether it’s building off the State’s master plan and/or building your unique plan independently, start now and start somewhere. And be prepared to change your plan constantly as the environment changes.

Not sure where to start? We’ve got you covered. In the following FAQs, we’ll provide advice for defining your:

- Business priorities

- People strategy

- Planning for a safe opening

Resources

Think about what your business needs to not just survive, but thrive. Start by considering your business outlook for the short-term and long-term future. Think about your business priorities and needs for the first 30 days of reopening and for the next 90 days, 6 months and 12-months ahead.

As you plan ahead, we recommend thinking through three key buckets of your business operations:

1. PRODUCTS & SERVICES

Reflect on how your business, customers, partners, competition have adapted in the last several months.

What products and/or services will you stop, continue, and improve?

Find products and services you can dial up to discover efficiencies and opportunities to help differentiate your business. Pairing down or distorting categories is a great way to take stock of what you’re selling and how it fits today’s consumer needs. There may be opportunities to work with new vendors who can contribute to new inventory needs. Or think broader and explore new ways to create revenue by offering your products to other businesses who are seeking it.

Tips:

- Focus on top sellers

- Highlight your highest margin offerings

- Know what will sell immediately. And know what will sell consistently over 2+ months

- Try and test new products and services, even if it’s uncomfortable

- Choose the product/service mix that will differentiate you

Work with vendors to ensure supply for your priority products

Questions to think through:

- What mix of products should I sell?

- Do I need to offer something new?

- What are my top/fastest sellers?

- What has the highest margin?

- What vendors do I need to work with to ensure supply?

- How can I differentiate my offering?

2. CUSTOMER ACQUISITION

Consumer behavior will look a lot different as our economy recovers. Hawaii’s high unemployment rate will contribute to less discretionary spending. And people will shop more on a need versus want basis. For this reason and many others, businesses will need to get creative with their customer acquisition strategy and leverage all the tools available to them.

Tips:

- Re-engage all existing customers across all channels

- Spread the word, ask them to bring their friends, relatives, acquaintances, and neighbors.

- Keep investing in digital and virtual channels to complement your brick-and-mortar

- Identify partnerships to reach new customers

- Focus on what makes your brand unique and different

Questions to think through:

- How can I acquire NEW customers?

- How do I reengage existing ones?

- How can I leverage digital channels?

- How can I perfect my brand?

- How do I improve foot traffic?

- What partnerships can I develop to expand my customer base?

- How can I be a good partner?

3. REVENUES & EXPENSES

Preparing for short-term and long-term business success includes being ready for various scenarios and unknown variables. How will you respond if consumer demand declines even further or if the government mandates re-closure of your business? How will you adapt to changing government restrictions on tourism?

Tips:

- Predict business outlook if consumer demand is Poor, Moderate or Outstanding

- Forecast conservatively low revenue numbers for the first 3+ months

- Consider how state requirements will impact your bottom line

- Evaluate the following items monthly: revenue, minimum staff required to support operations, payroll required to fund employees, and minimum fixed/variable expenses needed to stay open

- Determine how many months will your cash flow last

Note: If you are concerned about financial longevity and were approved for a PPP loan, we strongly encourage you to spend your PPP funds strategically over the long-term instead of making maximum loan forgiveness your only priority. Refer to our Strategic Use of PPP Funds for more guidance on this topic.

Questions to think through:

- What are my 30, 60, and 90 day sales projections?

- What’s the minimum # of staff I need to operate?

- How much payroll is required to fund employees returning to work?

- What will my PPP dollars fund?

- What are my minimum levels of fixed and variable expense?

- How can reduce, defer and extend terms on larger expenses?

Resources

Now that you’ve gotten clarity on business priorities, it’s time to get tactical by focusing on your people strategy.

Start by identifying employee skill sets that are most essential for business moving forward. In addition to operational and technical skills, think about more general competencies that will be necessary for reinvigorating your service culture, such as problem-solving, adaptability, leadership and collaboration. Deciding your core team/who to bring back should be aligned with your business strategy. Know that your financial situation may drive key staffing decisions. For example: If you anticipate a 30% reduction of revenues, consider bringing back 30% less staff.

Note: Know that your new business environment may require skill sets now and in the future. Don’t be pressured on bringing everyone back. It’s ok to keep some employees on furlough. It’s also okay to leverage Hawaii’s high unemployment to hire new talent to fill any skills gaps in your team. Spend the money on the best people. Think of it as an investment in the future.

Tips:

- Identify your talent needs and who will be able to execute your priorities/core business functions

- Only bring back the minimum number of employees necessary to accomplish business priorities

- Consolidate roles to eliminate redundancies

- Cross-train your employees to give your business more flexibility

- Hire new talent if you identify competencies that your business needs but current employees don’t have

- Consider bringing back your employees in phases

Resources

Next, determine if employees should a) work 100% onsite, b) work 100% remotely from home, or c) work onsite and remotely. Review all employee’s responsibilities and identify any activities that require them to be physically on-site. If an employee’s job doesn’t involve primarily in-person/onsite work, we recommend you ask them to work from home to minimize their risk of exposure and enable you to reduce the total number of people on site. Partial remote work is also an option for those who need to be onsite periodically.

Onsite Work

- Customer service and vendor meetings

- Core functions

- Streamlined communication

- Culture and camaraderie

- Innovation

Remote Work

- Accessibility with technology

- Improved focus

- Reduced commute time

- “Safer at home”

- Childcare and/or eldercare

- Potential cost saving

- Obtain better talent

Questions to consider:

- Does this employee interact with customers face-to-face regularly?

- Can the employee’s work be done by phone, email, and/or online meeting?

- Which projects or tasks would not be completed if the employee was not physically on-site?

- Is there sufficient workflow for the employee to work remotely instead of onsite?

Resources

How do you get your employees excited to come back to work? Before you pick up the phone to call people back to work, spend some time planning how you will bring them back. Why? The way you bring your people back is your first step to rebuilding workplace culture and re-connecting your team.

Here are four tips to get you started.

1. RE-ENGAGE EMPLOYEES

Start off the conversation with a tone of enthusiasm and gratitude. Remember, some of your employees may not be looking forward to your call or may still feel frustrated at being furloughed. Tell your employee how much you appreciate them and how excited you are about the possibility of working with them again. Explain that the loosening of government regulations means your business may be reopening soon and you would like to discuss the situation with them.

Tips:

- Tell employees your business may be reopening soon on [date]

- Explain that you’d like to discuss their work situation with them

- Build enthusiasm by reminding them of the long term benefits of employment (i.e., health care benefits, self purpose, stability, restart their career, serving the community)

- Reconnect/remotivate your employees with their sense of purpose (remind them of your mission, vision, purpose and values etc.)

2. LISTEN & EMPATHIZE

Be prepared to really listen. Hear out and empathize with employee concerns and be prepared to address any employee concerns, such as workplace safety, scheduling changes and frustrations at the possibility of not earning as much as on UI. Note: If an employee refuses to return because they’re collecting richer UI benefits, explain that unemployment payments are generous right now, but UI benefits aren’t long-term. Additional benefits from the CARES Act ends in July.

Tips:

- Take time to “talk story” e.g. ask them how they’ve been doing (and share something about yourself)

- Discuss your commitment to keeping the workplace safe for employees and customers

- Really listen and don’t interrupt

- Playback and summarize their thoughts to check for understanding/demonstrate empathy

3. SET EXPECTATIONS

Your employees are aware that the workplace has changed but that doesn’t mean they can read your mind. Set clear expectations about what your business and their work will look like in the “new normal”. Tell them what you need from them, and how you intend to support them also.

Tips:

- Share your expectations for how they will work differently

- Specify what you need from them (how you expect them to show up)

- Share details on compensation, salary, and benefits (highlight and explain any changes)

- Discuss your business’ short-term and long-term goals for the road ahead (and how its different than before)

- Get specific about how you will support them and what you promise to do as their leader

4. ASK FOR FEEDBACK COMMITMENT

Find out if they are willing and able to return and will be fully committed. Make the ask: Are you in? Determine if the employee is willing and able to return, has any new work constraints, and if he/she is fully committed to going above and beyond. If an employee says they’re not available (or not interested in returning to work), you may not want to jeopardize their UI by giving them an offer to return. When an employee refuses an official offer to return to work, they may lose their unemployment benefits. If you really need them back, have that hard conversion to convince them and work out a solution. You can consider additional benefits to entice them e.g. stipend, per diem to cover food/meals to help make up for lost wages, etc.

Tips:

- Give employees the opportunity to voice their ideas about how to the business/work culture

- Find out scheduling details and employee availability

- Conclude by communicating next steps

Resources

Here are important HR topics or policies you should cover with your team:

- Scheduling plans for the next 30 days (and beyond, if possible). If your workforce will be a combination of remote and onsite employees, discuss any new processes and norms for interacting together as a mixed workforce.

- General changes in salaries, benefits, and compensation packages. Discuss changes to individual employee compensation during a one-on-one meeting to maintain privacy.

- PTO, vacation, and sick leave policies for the upcoming weeks and months. Clearly explain any policy changes to pre-COVID policy and articulate your rationale to diffuse employee concerns.

- New safe workplace policies and procedures. Discuss your commitment to keeping the workplace safe for employees and customers. Clearly articulate any new cleaning/disinfecting and symptom checking processes you intend to put in place, as well as the consequences for breaking protocol.

Resources

TEMPERATURE CHECKS:

Businesses may consider taking employee’s temperatures before they enter the building, but remember that not all COVID-19 patients experience a fever.

SELF-CERTIFY / PRE-SCREEN:

You can also require employees to read and commit that they have no symptoms related to COVID-19 before they enter your work-place each day. This will help to keep your work-site safe and ensure the health and wellness of your team and customers. Download the Employee Covid-19 Certification Notice (Updated 10/7/2020) which you can post at the entrance to your workplace.

NOTE ON PRIVACY:

While HIPPA rules generally prohibit asking employees about their health, the EEOC updated its guidance on the Americans with Disabilities Act and the coronavirus, explaining that employers have the right to screen employees for COVID-19. However, mandatory medical tests must be job-related and consistent with business necessity.

Resources

BE INCLUSIVE

If an employee has a higher risk for Covid-19, you are not permitted to exclude an employee from coming back to work or take any other unfavorable action simply because you are concerned about their health. According to the ADA, this is not allowed unless the employee’s disability presents a “direct threat” (significant risk of substantial harm) to his or her health and cannot be addressed by any other reasonable accommodation.

BE PROACTIVE

Proactively make accommodations that reduce or eliminate the direct threat of Covid-19, such as:

- Providing PPE beyond what all employees are expected to use, such as gloves and gowns

- Installing barriers to separate the at risk employee from colleagues or customers

- Changing job functions

- Alternating work schedules

- Modifying work locations

- Allow for remote work

ENSURE LEGAL COMPLIANCE

If an employee requests a reasonable accommodation because they have a medical condition that makes them higher-risk for Covid-19, here what you need to know:

- You may request a doctor’s note as documentation once your employee (or a third party, such as a doctor) informs you in writing or in conversation of the need for an accommodation.

- You can also ask clarifying questions about why the accommodation is needed and how the requested change will enable the employee to perform essential job duties.

- Generally speaking, you will be required to make the accommodation unless it creates an ‘undue hardship’ to your organization. Undue hardship is determined by assessing whether the requested accommodation will significantly impact other employees’ ability to perform their duties as well as the financial impact on the organization.

Life and work amidst COVID-19 presents several potential HR pitfalls, especially as you make decisions about how to staff onsite locations. Can you choose not to bring back older employees or employees with pre-existing health conditions if you want to keep them safe? Even if they did not request an accommodation? Can you pay to keep a COVID-recovered employee home because other employees are still worried about being infected?

Here are examples of discriminatory selection when it comes to deciding which employees to return to work:

- Bringing back only young employees perceived to be healthy individuals

- Choosing not to bring back other “high-risk” individuals

- Choosing not to bring back mothers with young children

Resources

All employers must create a safe working environment that gives employees the confidence to return to work, and customers confidence to engage. Properly disinfecting your entire business and designing customer-facing areas that work is critical. Here’s what we suggest you do:

1. PRE-CLEAN & ESTABLISH YOUR ONGOING CLEANING PLAN

- Review OSHA and CDC guidelines for detailed guidance and disinfecting how-to’s

- Order cleaning supplies and EPA-approved disinfectants and maintain at least a 30-day inventory

- Thoroughly clean and disinfect your business before you reopen

- Create an ongoing cleaning schedule for all areas (e.g. between customers, hourly, daily, or weekly)

- Identify and clean high-touch surfaces

- Avoid food contact when using disinfectants

- Add hand sanitizer stations, preferably touchless, at entrances/exits/checkout

- Follow OSHA/HIOSH guidelines for proper labeling, use and storage of chemicals

- Have an enhanced cleaning plan ready should a positive COVID-19 case be reported

2. CREATE PPE & PHYSICAL DISTANCING RULES

- Require employees and customers to wear a mask before entering

- Require employees to wear appropriate PPE

- Post signage to communicate key distancing rules and reminders in high-traffic areas

- Designate one location for any deliveries, require all vendors to wear face masks, disinfect all items, and only allow vendors to enter when escorted by an employee

3. DETERMINE PRODUCT HANDLING & LIMIT SHARING

- Determine standards for product handling so that it limits employee contact

- Consider “contactless” checkout options e.g. pick-up/curbside, self-checkout or contactless payment options (e.g. RFID credit/debit cards, Apple Pay etc.)

- Limit sharing equipment and consider assigning equipment/tools per person, per shift

- If sharing items is necessary, post clear directions about how to clean shared-use equipment

4. REORGANIZE YOUR FLOOR PLAN & TRAFFIC FLOW

- Ensure 6 ft spacing and add floor markers to help with distancing

- Designate specific entrances and exits to control traffic and reduce contact

- Install safeguards to prevent transmission of airborne particles that may carry the virus e.g. plexiglass or get creative with economical barriers like clear, thick plastic

- Establish paths (e.g. one-way, clock-wise) to minimize proximity for customers and employees

5. LIMIT THE NUMBER OF PEOPLE IN A CLOSED SPACE

- Reduce worksite occupancy based on county and state capacity rules. Establish an occupancy monitoring protocol to maintain the appropriate capacity

- Adapt breakrooms/waiting areas for social distancing and stagger breaks to prevent crowding

Flexible Operations

Here’s what our banking partners at American Savings Bank say:

- Identify your immediate cash needs and demands

- Calculate the cash you need to cover your business’s core operations for at least the next 45 days

- Run and update each week a cash flow forecast to monitor your short-term cash position carefully.

If you do not have sufficient cash in the bank to cover these 45-day expenses, consider the following actions:

- Collect on accounts receivables—now is not the time to let others hold onto the cash that is rightfully yours

- Draw on your existing line of credit (if you already have one) to establish at least a 45-days worth of cash reserves. Consult your banker to determine if it makes sense to hold an even larger buffer.

- Apply for a Small Business Administration Loan—there are several available options to employers during this pandemic.

Note: ProService Hawaii has outlined several business relief programs that are currently available to employers in our Relief Programs Guide.

Resources

- The Small Business Guide to Relief Programs for COVID-19 (ProService Hawaii)

- SBA Disaster Assistance in Response to the Coronavirus (Small Business Administration)

Thousands of employees in Hawaii still receive live checks. For those who aren’t set-up with direct deposit, the stakes of going to the bank or a check-cashing facility to deposit their physical checks as coronavirus (COVID-19) continues to threaten public health are high.

If some employees still receive live checks, we strongly urge employers to advise your team to switch to direct deposit. Should the coronavirus reach crisis levels, postal systems or banks may choose to adjust their operations. Switching to direct deposit ensures that employees receive a paycheck without hiccups. Similarly, setting-up and becoming familiar with mobile banking is strongly encouraged.

In recent days employers have been faced with very difficult and unanticipated situations in the workplace. As the coronavirus continues to spread across the state and country, employee absences from the workplace will be more frequent—whether related to personal or family illness due to the virus, school closures, voluntary or involuntary quarantines, fear of contracting the virus, etc.

As an employer, you need to be ready to adapt your business practices to maintain critical operations.Here are some things you might consider:

- Cross-training employees to carry out essential functions so you can operate when essential staff are out.

- Identifying alternative suppliers to meet supply chain needs.

- Prioritizing customers with the greatest needs.

- Preparing to temporarily suspend operations if necessary.

Remote Work Tips

At this time, the goal should be to prevent, or decrease, the spread of COVID-19 in the workplace and lower the impact of COVID-19 onto your business operations. Now is the time for proactive, creative thinking to safeguard your employees’ health and your business. Here’s practical steps you can take to be prepared for any emergency.

Assess employees’ core work & in-person requirements:

Determine what people and resources are required for your business to operate. Take a look at existing employee roles and responsibilities. Identify the following:

- What has to get done on-site and in-person

- What can be done, even partially, through remote work.

For work that requires physical presence (e.g. restaurant work), start thinking through your contingency plan. This may include engaging a temp agency to quickly find healthy contractors to do the work. Or, this could include implementing on-call staffing policies to manage short staffing.

For work that can be handled outside the workplace, consider reevaluating your remote-work policies. Encourage managers to challenge default assumptions about the flexibility of certain roles as they think through their options.

Evaluate resources & leverage technology:

Maybe you’ve determined that an employee doesn’t need to be physically in the office to do their core work. But do they have the right resources and access to do their job at home?

One of the great ways to stay connected if you pursue remote work is to use technology. Things like setting up employees with video conferencing, leveraging document sharing tools like Google Docs, or loaning out laptops or other devices to employees that don’t have access to a personal device to do work.

Determine what tools the employee needs to do their job. For example:

- Desktop or laptop computer

- Internet access

- Secure access to applications and data

- Online communication and collaboration tools like Zoom or GSuite

- Home phone or cell phone with adequate data

Test your plan & get input:

Your plan is more likely to be successful if you get buy-in from employees and partners. Invite your employees to help develop and review the plan. If it’s not possible to talk with every team member, try sampling a variety of departments in your organization.

Consider testing out your plan to help detect gaps or problems that need attention, and sharing your completed plan with employees. Explain what benefits are available to them, including paid time off, flexible scheduling,and health care coverage.

Establish a communications protocol

Last but not least, communicate with your employees. Set-up a protocol on how to reach everyone (G-chat, text, phone call etc.) to handle staffing and work loads. If you’ve updated your remote-work plans, share it widely with all your employees and be available to answer questions as they arise. Consider organizing a company huddle to address concerns and align everyone on the plan moving forward.

Resources:

- Free ebook: Unexpectedly Transitioning to Remote Work (ProService Hawaii)

- Remote Work Team Norms Checklist (ProService Hawaii)

- How Google is helping businesses and schools stay connected during COVID-19 (Google Cloud)

- Support during the COVID-19 pandemic (Zoom Video Conferencing)

- Webinar: Remote work 101 (ProService Hawaii)

If an all-remote or majority-remote workforce is not practical for your business, ideas to discuss among your management and operations teams are:

- Splitting or staggering shifts to lessen the amount of people in the workplace at one time

- Cross-training employees to perform critical functions so that your business is able to operate even if key employees are absent.

- Identifying truly critical functions your business needs to run.

Temporarily weeding out the not-so-critical functions so you are able to staff your office and/or remote workforce appropriately without increasing the risk of the spread of COVID-19.

You’ve decided that remote-work makes sense for your business and your team. Now what?

Some of your team may feel thrilled about the possibility of working remotely—but not everyone will feel that way. Some may dread it. But if remote work is our new reality, your role is to help employees make the best of it.

Here are some quick tips:

Tip #1: Set up your workspace

- Pick one spot and dedicate it to work

- Keep everything in one place

- Stay off the couch

- Get dressed

Tip #2: Establish hours, breaks & boundaries

- Create a routine — and stick with it.

- Set a regular time for lunch and breaks

- Prioritize tasks and chunk your time

- When the work day is over, it’s over

Tip #3: Anticipate and plan to deal with distraction

- Communicate your needs

- Coordinate schedules

- Create and reinforce boundaries

- Use headphones

Tip #4: Take care of yourself physically and mentally

- Move your body

- Connect with people

- Choose your mindset

For more detailed tips, download a free copy of our ebook: For the full detailed version of our tips, download a free copy of our ebook: Unexpectedly Transitioning to Remote Work.

Resources:

- Free ebook: Unexpectedly Transitioning to Remote Work (ProService Hawaii)

While remote work is nothing new, it’s the first time so many people have made the shift at once — so it’s natural for some to find the transition challenging.

One of the biggest questions many employers have is how they will be able to communicate with and manage their team. How will you know if people are getting their work done? How can you build relationships if you’re not seeing your people every day? The uncertainty of how things will work can add to an already stressful situation.

Fortunately, there are things you can do to make communication and management easier.

Tip #1: Stay connected while remote

- Pay attention to the quality of your communication

- Think about when and how often you reach out

- Strengthen customer relationships

Tip #2: Give clear direction, then let people do their jobs

- Articulate your expectations

- Establish clear deliverables

- Then back off

Tip #3: Run effective meetings

- Practice using new platforms

- Set the ground rules

- Have an agenda

- Stick to video

Tip #4: Make people feel supported

- Use emotional intelligence

- Make sure your staff doesn’t get burned out

- Ask for feedback

For the full detailed version of our tips, download a free copy of our ebook: Unexpectedly Transitioning to Remote Work.

Reopening Videos

Update from the Experts

HR Practices & Policies

Our experts provide practical things employers can act on today. From working from home to stress management tips, get ideas and inspiration to consider for your workplace.

- Tiffany Donnelly, Director of HR at ProService Hawaii

- Janina Abiles, Director of HR & Safety Training

Update From the Experts

COVID-19 Workplace Scenarios

Our experts provide quick answers to the top questions we're hearing from our clients (and their employees) right now.

- Michelle Kim Stone, Corporate Counsel & Director of Legal Operations at ProService Hawaii

- Janina Abiles, Director of HR & Safety Training

What's Working? What's Not?

What's Next For Your Favorite Restaurant

This webinar was recorded on July 9, 2020.

We sat down with an amazing group of restaurant leaders to talk about their experiences through reopening, lessons learned, and their thoughts on what's ahead in the next few months.

Video Timestamps

[4:17] What's working – takeout, menus, and specials

[10:30] What's next – plans for coming months

[28:40] Getting the word out and marketing strategies

[37:52] Putting safety first

[45:40] Learning from corporate or mainland counterparts

[55:58] Closing Thoughts

Reopening and Operating Your Educational Program

This webinar was recorded on July 1, 2020.

Learn suggestions and best practices for protecting your staff and students, complying with social distancing guidelines, and implementing protective measures to prevent the spread of coronavirus in an education environment.

Working in The New Normal: A Training for

Healthcare Employees

This webinar was recorded on June 16, 2020.

Learn suggestions and best practices for protecting your employees, complying with social distancing guidelines, and implementing protective measures to prevent the spread of coronavirus in a healthcare setting. Examples of companies that benefit from this course: medical and dental practices, chiropractic offices, vision care offices, diet and health coaching services, urgent care, and walk-in clinics.

The New Normal: Operating Your Construction Company

This webinar was recorded on June 5, 2020.

Learn suggestions and best practices for protecting your employees, complying with social distancing guidelines, and implementing protective measures to prevent the spread of coronavirus in a construction worksite.

The New Normal: Operating Your Professional Office

This webinar was recorded on June 5, 2020.

Learn suggestions and best practices for protecting your employees, complying with social distancing guidelines, and implementing protective measures to prevent the spread of coronavirus in an office work environment.

Working in the New Normal: A Training for Employees

This webinar was recorded on May 29, 2020.

Share this video with your employees to educate them on practical strategies and steps to work safely in the “new normal”. In this webinar we’ll cover 3 important aspects:

- Ensuring you are healthy to work

- Keeping a clean and safe work environment

- Delivering safe customer service

Reopening and Operating Your Restaurant

This webinar was recorded on May 29, 2020.

Learn to protect your employers, customers, and ensure a safe worksite for everyone. Ensure you are familiar with the Department of Health Dine-in Guidelines.

Reopening and Operating Your Retail Business

This webinar was recorded on May 26, 2020.

In this course, we discuss how to protect your employees, your customers, and your store with appropriate cleaning, physical distancing, and training.

Recipes for Reopening

This webinar was recorded on May 21, 2020.

Hear our restaurant panelists discuss the challenges they face and how they're overcoming them to reopen their dine-in services. Our panelists include:

- Jason Wong, Sysco Hawaii

- Don Murphy, Murphy's Bar & Grill

- Erik DeRyke, ProService Hawaii

The New Normal: How to Make a Comeback

This webinar was recorded on May 20, 2020.

Hear how thought leaders in our community are pivoting their businesses, and using COVId-19 driven innovations to define their New Normal. Our panelists include:

- Elisia Flores, L&L Hawaiian Barbeque

- Matt Heim, HONBLUE

- Christine Lanning, Integrated Security Technologies

- Ben Godsey, ProService Hawaii

- Moderator: Steve Petranik, Hawaii Business Magazine

Reopening Your Business to Survive and Thrive

This webinar was recorded on May 12

Get guidance from our panel for reopening your business to not only survive but to thrive. Our panel of experts include:

- Scott Maroney, Crazy Shirts

- Nelson Befitel, ProService Hawaii

- Jordan Conley, Obsidian HR & ProService Hawaii

- Elena Martinez, ProService Hawaii

Resources From This Webinar

Running a Business in Crisis Videos

Creating a Pandemic Response Plan

This on-demand training was recorded on August 18, 2020.

Ensure safety for you and your employees with our expert guidance on how to create a workplace pandemic response plan. Learn essential strategies for assessing exposure risk, implementing workplace controls and handling a positive case.

Remote Work

This webinar was recorded on March 26, 2020

We provide tips and strategies to stay productive and connected with your team. Hosted by: Marissa Page, Learning & Development Specialist, ProService Hawaii.

Timestamps

[5:23] Intro: Work as we know it is changing

[8:20] Webinar goals

[10:06] Tips to boost productivity

[13:00] Set-up your workspace

[31:31] Hours, breaks and boundaries

[39:22] Anticipate distractions

[45:27] Physical and mental health

[48:27] Choose your mindset

Ergonomics

This webinar was recorded on April 9

We discuss causes and risk factors in your daily work and how to utilize proper postures and stretching exercises. Hosted by Jason Propst, Safety Training & Development Specialist.

Timestamps:

[1:38] Ergonomics defined

[2:56] Cause and risk factors

[9:56] Types of injuries

[12:37] Ergonomic solutions

[20:46] Ergonomic exercises and stretches

Leadership Series #3: Five Fundamental Components of Resilient Leadership

We discuss the components needed to drive resilience as a leader.

Timestamps:

[1:09] Heart & head

[2:30] Mission driven

[4:18] Speed over elegance

[5:21] Own the narrative

[6:32] Embrace the long view

Leadership Series #4: Adopting A Growth Mindset

We discuss how to develop a growth mindset that can help you reinvent your business and seek opportunities for future growth.

Timestamps:

[0:47] Fixed mindset vs. growth mindset

[2:17] Leadership mindsets

[4:46] Expectations

[5:46] Reinvention

[6:20] People strategies

Relief Programs

Learn about programs available to help you

retain employees and sustain your business during this crisis

There are several government relief programs now available to small businesses and their employees. You may have heard of a few:

Small Business Loans:

- Paycheck Protection Program (PPP)

- Economic Injury Disaster Loans (EIDL)

- SBA Bridge Loan

- SBA Debt Relief

Employer Tax Credits:

- Employee Retention Tax Credit

- Payroll Tax Deferral

Employee Leave:

- Family First Coronavirus Response Act

Trying to identify which one is most applicable and beneficial for your situation can be complicated, but it doesn’t have to be.

Keep on reading to learn more about these programs in-depth. Or, read our SMB Guide to Relief Programs for COVID-19 to get an overview of each one.

Resources:

Updated on 4/24: The CARES 2 Act, a $484 billion relief bill, has been signed into law. Of this, the Paycheck Protection Program (PPP) will receive an additional $310 billion and the Economic Impact Disaster loan (EIDL) program will receive $60 billion.